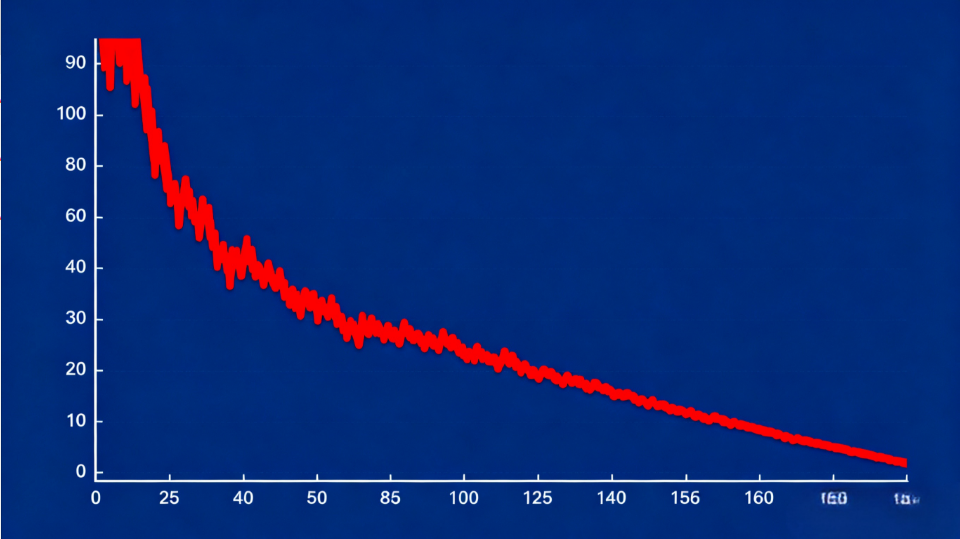

On October 20, due to investor concerns over bond violations, Vietnam's stock market experienced its largest decline since April. The market suddenly plummeted in the final moments before closing, with the benchmark Ho Chi Minh Index falling nearly 5.5%, marking the largest single-day drop since the impact of the tariff incident in early April this year.

By the close, the MSCI Vietnam Index had fallen 5.85%, while the Ho Chi Minh Index dropped 5.18%.

According to statistics, nearly 150 stocks hit limit-down in the Vietnamese market on Monday. Real estate, securities, and banking sectors were the main targets of investor sell-offs, with 8 out of the 14 bank stocks in the VN30 Index (comprising the 30 largest listed companies in Vietnam by market cap) hitting limit-down.

On the news front, local media reported that the Vietnamese Government Inspectorate announced inspection results for 67 bond issuers (including 5 banks) and pointed out "multiple violations." These violations included improper use of raised funds, insufficient information disclosure, poor capital management, delays in repaying principal and interest, and premature project sales.

An analyst stated that investor sentiment "deteriorated" after the inspection results were revealed. He also mentioned that Novaland Investment Group's announcement of its inability to fulfill payment obligations for its convertible bonds further intensified market pressure.

Another analyst said, "The strong rebound over the past few months prompted retail investors to increase leverage. Once negative news emerged, the market became prone to triggering passive sell-offs. The combination of these factors led to widespread declines across sectors today, with panic sentiment spreading."