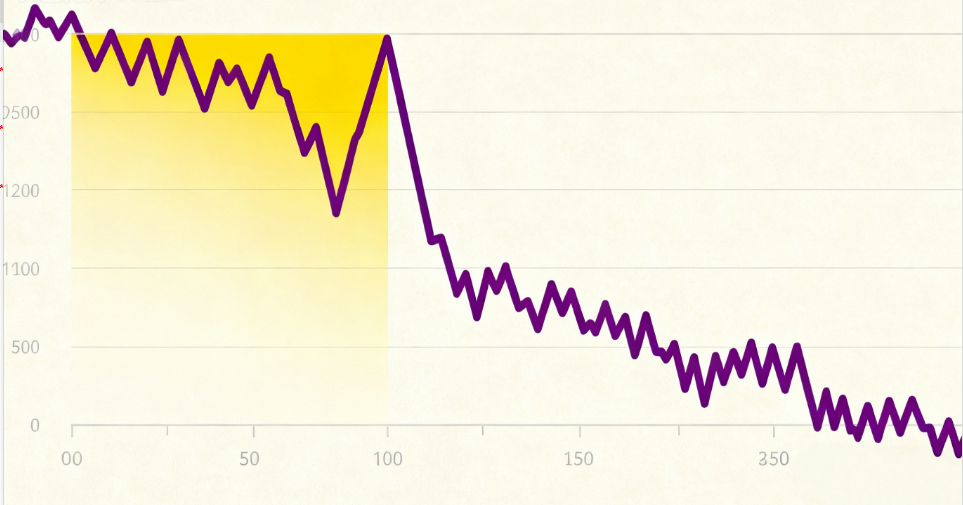

On October 17, Japanese and South Korean stock markets fell. As of the time of reporting, the Nikkei 225 index had extended its decline to 1%.

Affected by the sharp drop in U.S. bank stocks overnight, Japanese financial stocks declined. As of the time of reporting, Japan's banking index fell by 1.88%, making it the worst-performing index among the Tokyo Stock Exchange's industry classification indices. In terms of individual stocks, Mizuho Financial Group, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group all fell by over 2%.

Analysts at JPMorgan Chase & Co. stated that the banking sector is an area where investors tend to "sell first and ask questions later." The rapid deterioration in market sentiment is becoming a greater concern than the banks' balance sheets themselves.

With the Bank of Japan's meeting at the end of the month approaching, Governor Kazuo Ueda has not ruled out the possibility of an interest rate hike. Bank of Japan Governor Kazuo Ueda stated that if confidence in achieving the economic outlook strengthens, the central bank will continue to tighten policy—meaning the door for a near-term rate hike remains open.

After attending the G20 meeting in Washington on Thursday, Ueda told reporters, "Our stance remains unchanged. If our confidence in achieving the economic outlook strengthens, we will adjust the degree of monetary easing." Since last year, the Bank of Japan has been reducing monetary stimulus through interest rate hikes and adjustments to its balance sheet policy. However, Ueda indicated that he might wait until the last moment before the next policy committee meeting. He stated that he plans to continue gathering information during ongoing international meetings and assess the received data before the October 29-30 meeting.

Ueda noted that the global economy is resilient but faces high uncertainty and complex challenges that could pressure medium- to long-term growth prospects. He said the delayed impact of tariffs on the global and U.S. economies is contributing to this resilience. In the future, monetary policy decisions will be based on a comprehensive assessment of economic and price prospects, risk conditions, and the likelihood of forecasts being realized.