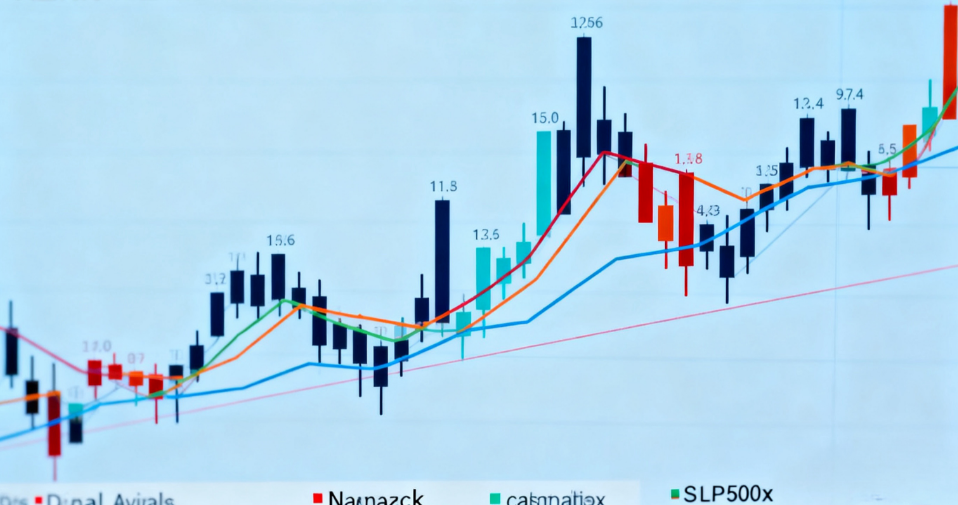

On Thursday Eastern Time, the three major U.S. stock indices collectively closed lower. At the close, the Dow fell 0.65% to 45,952.24 points; the Nasdaq fell 0.47% to 22,562.54 points; and the S&P 500 fell 0.63% to 6,629.07 points.

In recent weeks, although the S&P 500 has hovered near historical highs, underlying tensions on Wall Street have been simmering. Growing investor concerns about the health of the U.S. credit market have added to a series of worries they face, including a government "shutdown," concerns about an AI bubble, and trade tensions.

Large-cap tech stocks mostly fell: Tesla closed down 1.47%, Meta down 0.76%, Apple down 0.76%, Amazon down 0.51%, Microsoft down 0.35%, while Google Class A rose 0.17%, and Nvidia gained 1.10%.

Precious metal concept stocks led the gains: Newmont rose 5%, Harmony Gold gained 3.5%, and Coeur Mining advanced 3.7%.

Most popular Chinese concept stocks declined: the Nasdaq Golden Dragon China Index closed down 0.91%. Century Interconnect fell over 5%, Kingsoft Cloud dropped over 2%, while XPeng Motors, JD.com, and Miniso each fell over 1%. Bilibili rose over 1%.

Gold's rally continued, with London spot gold touching $4,380.79 per ounce during the session, setting another historical record high.

This week, several major U.S. banks reported better-than-expected third-quarter earnings.

According to foreign media reports, boosted by a significant increase in deal-making activities, corporate spending, and robust consumer activity, banks including JPMorgan Chase, Bank of America, and Goldman Sachs reported third-quarter profits and revenues that exceeded analyst expectations. Increased confidence among corporate executives, low delinquency rates on consumer debt, and rising stock markets all helped these banks generate profits.

Overall, the six largest U.S. banks (JPMorgan Chase, Bank of America, Wells Fargo, Morgan Stanley, Goldman Sachs, Citigroup) collectively generated nearly $41 billion in profits over the past three months, a 19% increase compared to the same period last year.