On August 29, 2025, the US Treasury market showed significant changes. According to US Treasury data, at the close of the previous trading day (August 28), the constant maturity yield on the 2-year Treasury note fell to 3.59%, its lowest level since September 27, 2024. This decline even surpassed the lows seen during the market turmoil in April 2025. This adjustment in the yield curve is not an isolated phenomenon but rather a noticeable sinking across the entire curve, particularly at the short end (specifically the 2- to 5-year segment), indicating a repricing of the market’s expectations for future interest rate paths.

This change has sparked widespread discussion. Mainstream media and economists often focus on Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium, viewing it as the primary driver behind the decline in short-term yields. However, objective analysis shows that this is only part of the story. The reshaping of the yield curve more reflects market expectations regarding economic fundamentals, including a softening labor market, fading inflationary pressures, and the inevitability of Fed policy adjustments. More importantly, long-end yields (such as the 10-year) have not surged as expected but continue to challenge predictions of a “yield explosion.” This suggests that the market is not “rejecting” US Treasuries but rather expressing expectations for a low-interest-rate environment through curve adjustments.

Misconceptions in Mainstream Views: Inflation and Treasury Supply Glut

Over the past year, financial and social media have been dominated by two main narratives arguing that interest rates should remain high or rise further. The first is inflationary pressure, particularly so-called “tariff inflation.” Over the past three years, the Fed has repeatedly emphasized inflation risks, claiming the economy is strong and only limited rate cuts (e.g., one cut) are needed. However, market data show that such concerns lack empirical support. The phased rise in consumer prices from 2021 to the first half of 2022 was more due to supply shocks (such as the pandemic and geopolitical factors) rather than sustained inflation. Data from 2025 show that core inflation has stabilized near the 2% target, and a cooling labor market has further suppressed price pressures.

For example, Powell’s stance at the 2025 Jackson Hole symposium significantly downplayed the threat of tariff inflation, instead acknowledging labor market weaknesses. This was not a sudden shift but an outcome long anticipated by the market. The decline in short-term yields reflects a market consensus that the Fed will be forced to cut rates, not the exorcism of inflation “ghosts.” Economists often attribute inflation to excessively loose monetary policy while overlooking the roles of global supply chain recovery and weak demand. Objectively, this bias stems from the Fed’s and economists’ limited understanding of inflation sources, as they tend to rely on outdated Phillips curve models, while the market more accurately captures reality through forward-looking pricing.

The second misconception is that a “Treasury supply glut” is causing global “rejection” of US Treasuries. Some views link this to political factors, such as protests against Trump’s policies; others emphasize the massive debt scale and lack of buyers. Admittedly, US federal debt has exceeded $37 trillion (excluding intragovernmental holdings), which indeed crowds out the private sector and exacerbates economic inequality. However, this does not mean the Treasury market is in crisis. On the contrary, the debt burden increases downward economic pressure, which in turn boosts demand for safe assets like US Treasury bonds.

Historical data show that high-debt environments often coincide with low-interest-rate cycles, as investors seek liquidity and safety. Treasury auction results from 2024 to 2025 further refute the “rejection” narrative. For instance, this week’s auctions of 2-year and 5-year notes saw the high yield (auction clearing rate) hit its lowest since last September, indicating strong demand. Although the bid-to-cover ratio dipped slightly, this is not a signal of oversupply but a natural result of reduced participation by pure investors as yields fall. When yields retreated from decade highs in 2023, investors shifted to other assets for higher returns, but overall demand did not weaken. Instead, auction prices continued to rise, confirming market preference for Treasuries.

The root of these misconceptions lies in the media’s reliance on the perspectives of economists and central bank officials, who are often detached from market realities. Economists’ models assume the Fed controls all interest rates, but in reality, market dynamics of supply and demand dominate pricing. Social media amplifies minority opinions, creating an echo chamber effect that causes the public to overlook the behavior of most market participants.

The Reshaping Mechanism of the Yield Curve: From Inversion to Bull Steepening

Changes in the yield curve are key to understanding current dynamics. In 2023, the curve was deeply inverted (the 2-year/10-year spread reached record negative values), reflecting market expectations that short-term rates would rise due to Fed hikes, while long-term rates would remain low due to a bleak economic outlook. This was consistent with the flattening that began in 2021, when the market already foresaw the negative impacts of pandemic aftermath and supply shocks.

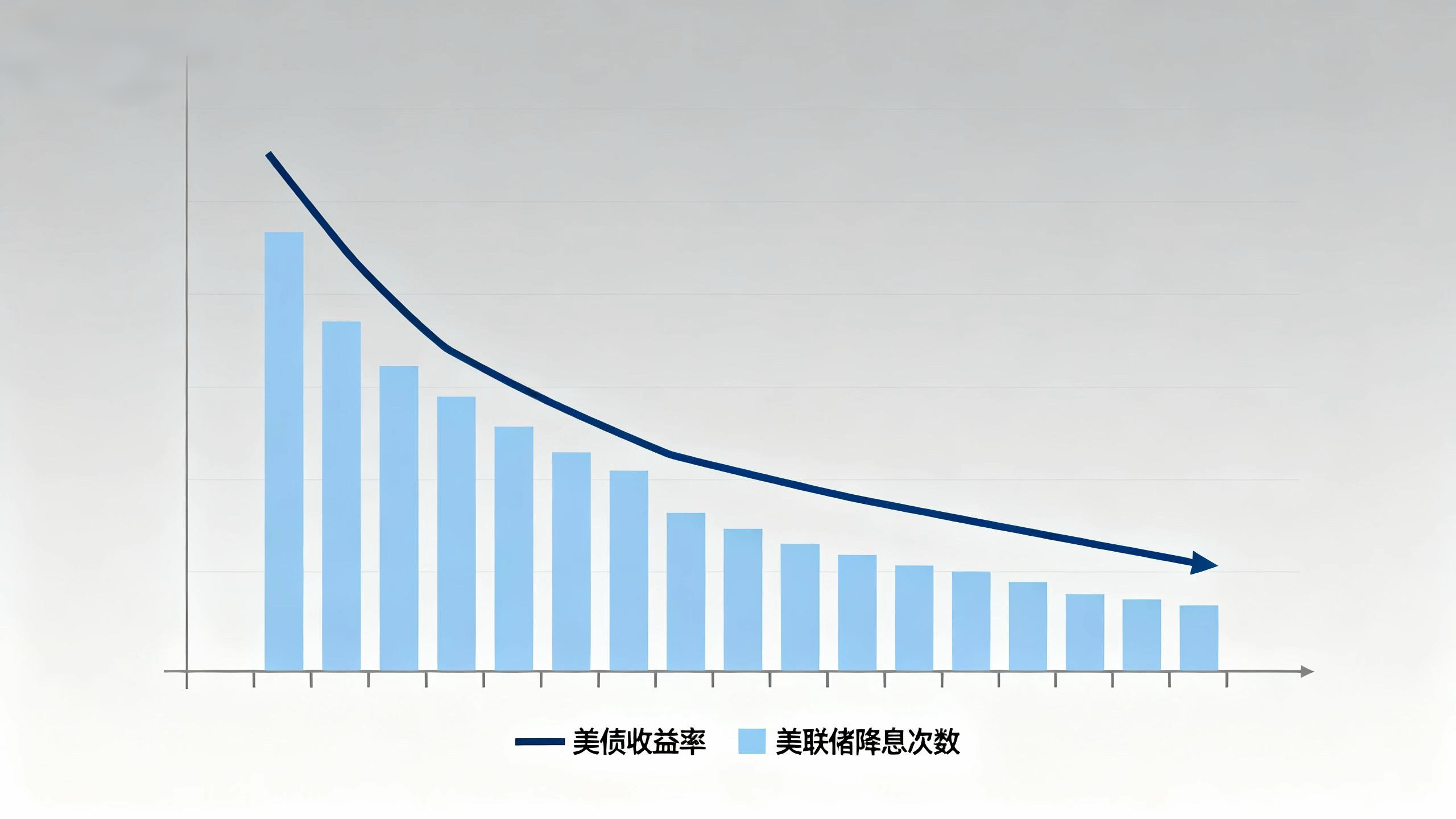

By late August 2024, the curve began to uninvert, with the 2-year/10-year spread turning positive by 1 basis point, then widening to 25 basis points after the Fed’s first 50-basis-point rate cut in September. This process is not anomalous but a typical “bull steepening.” In bull steepening, short-term yields fall faster, causing the curve to steepen from the front end, while long-term yields remain relatively stable or rise slightly. This contrasts with “bear steepening,” where long-term yields rise sharply.

Why does bull steepening occur? First, Fed rate-cut signals flip risk-return parameters. During inversion, investors prefer long-term Treasuries for safety; after cuts begin, short-term Treasuries have greater potential because once the Fed starts cutting, it often finds it hard to stop. Historical cycles show that after the Fed’s first cut, short-term yields decline rapidly, while long-term yields hold steady due to economic uncertainty. After September 2024, long-term yields briefly rose, but this was not a “rejection” of Treasuries; rather, it was the steepening mechanism: the market shifted from long-end to short-end, pushing long-end prices relatively lower.

Second, economic fundamentals support this reshaping. Labor market data show slowing job growth, and the Beveridge curve (the relationship between unemployment and job vacancies) has shifted rightward, indicating structural weakness. The Fed acknowledged this “transition,” with Powell emphasizing labor risks over inflation at Jackson Hole. This aligns with market expectations: economic weakness is forcing the Fed to cut rates, not keep them high. Goldman Sachs strategists noted that the relative value of 5-year Treasuries (compared to shorter and longer maturities) is at historically high levels, similar only when the Fed was near zero rates. This is no coincidence but reflects market pricing of the Fed returning to an ultra-low rate path.

Additionally, recent movements in swap spreads and forward rates further confirm this. Narrowing swap spreads indicate ample liquidity, while declining forward rates suggest expectations of long-term low rates. Even Fed officials like John Williams have begun acknowledging this reality, hinting that the late 2020s rate environment may resemble the 2010s.

An objective comparison with historical cycles: In 2005, Fed Chair Alan Greenspan called the failure of long-term yields to rise with hikes a “conundrum,” but this stemmed from a flawed assumption—that the yield curve follows the Fed like a series of one-year forward rates. In reality, the market prices independently, considering global factors, economic cycles, and investor behavior. The steepening in 2024–2025 is not a new conundrum but a repetition of historical patterns.

Treasury Auctions and Market Signals

Treasury auctions are direct evidence to test the “rejection” narrative. Auction data from 2025 show strong demand. For example, this week’s 5-year auction saw the high yield drop to its lowest since last September, despite a lower bid-to-cover ratio, indicating buyers are willing to accept lower returns. This is not about investors shifting from a high-yield environment but rising demand for safety.

Analyzing the bid-to-cover ratio: For 2-year and 5-year notes, this ratio fluctuates inversely with yields. As yields fell from 2023 highs, pure investors decreased, but safe funds (e.g., pension funds, foreign central banks) increased. Since April 2025, despite declining 2-year yields, auction bids have risen, reflecting safe-haven sentiment and bets on further Fed rate cuts.

Broadly, foreign holdings of US Treasuries remain stable, and global capital inflows have not diminished. Although the debt burden is heavy, its status as a reserve asset remains unchanged. The media exaggerates个别 “poor” auctions while ignoring the overall trend: rising prices and falling yields.

Future Outlook: Low-Rate Path and Policy Implications

The reshaping of the yield curve suggests that rates will fall further and remain low. The sinking short end indicates the market expects the Fed to accelerate rate cuts, with the target federal funds rate potentially nearing zero. Stable long-end yields challenge “explosion” predictions, reflecting economic downturn rather than resurgent inflation. The Fed should focus more on market signals than internal models. Economists need to rethink inflation and interest rate theories, avoiding political biases. Investors may focus on short-term Treasury opportunities but should be wary of recession risks.

Overall, this reshaping is not Fed-led but a market response to reality. Ignoring mainstream noise and focusing on data will help in understanding future dynamics.