Investor Structure Becomes Increasingly Diverse

With the rapid development and continuous expansion of the public REITs market, these assets have become more familiar to investors and are increasingly valued in asset allocation.

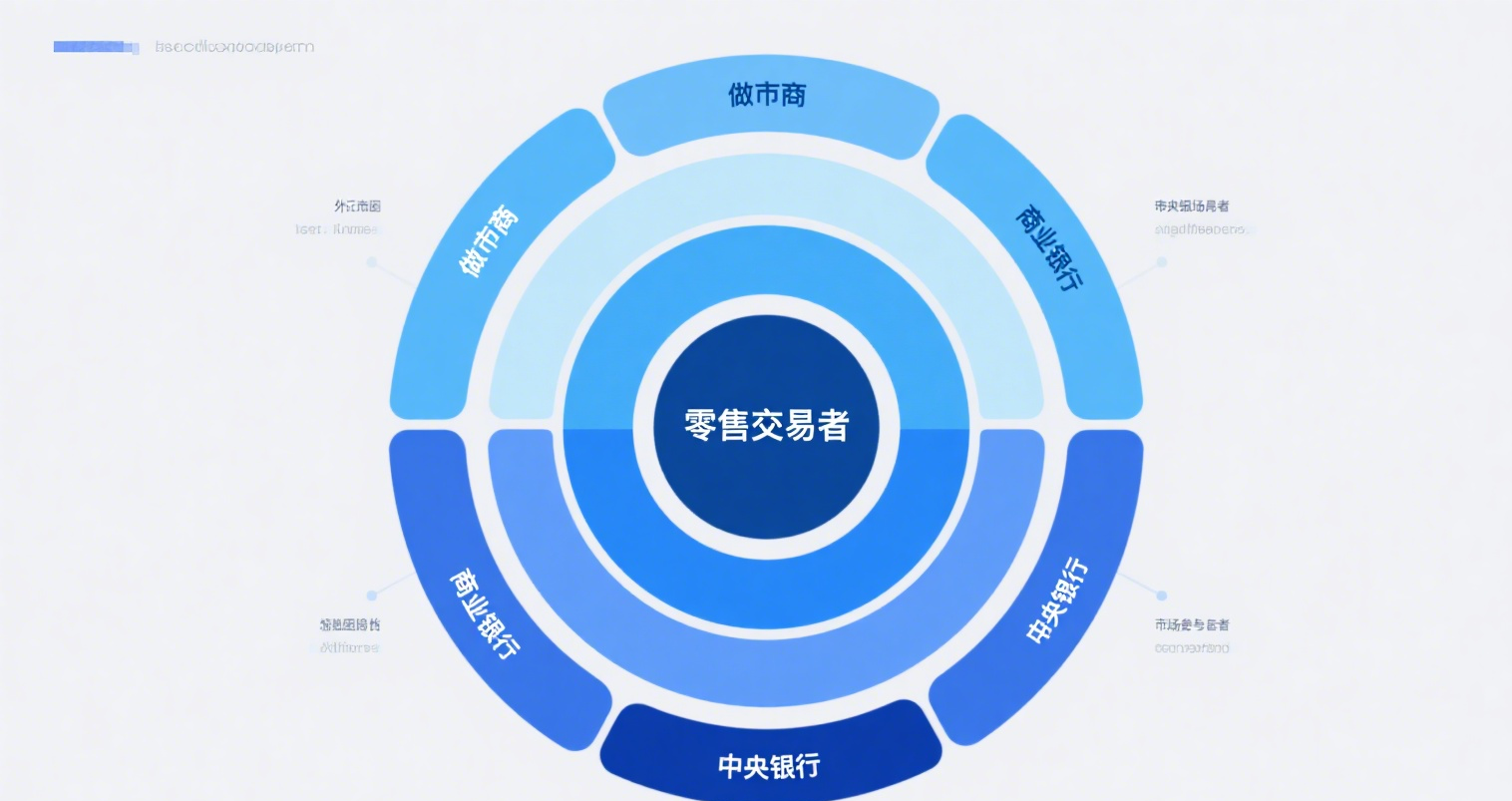

"From the perspective of participating investor types, the public REITs market has largely formed an institution-dominated landscape," said Zhu Yuanwei, Dean of the RuiSi Real Estate Finance Research Institute, in a recent article. Currently, institutional investors account for 96% of the market, with bank proprietary investments and insurance capital being the first and second largest segments, respectively. Notably, since the fourth quarter of 2024, trusts, private equity funds, and small-to-medium investment institutions have also accelerated their entry, becoming new variables in the market. Bank wealth management products have also gradually re-entered the market through channels such as trusts and insurance asset management plans.

According to Zhu Yuanwei’s statistics on public REITs’ strategic placements since 2025, state-owned capital operation platforms, represented by China Reform Holdings, have been actively participating in strategic placements, emerging as a "new force." The deep involvement of such institutions facilitates cross-regional and cross-industry integration of central and state-owned enterprise assets while also providing a key tool for regional asset coordination.

Looking at the strategic placement preferences of different types of institutions, state-owned capital platforms focus on asset integration value, while small and medium-sized insurers and professional real estate institutions prioritize asset quality and operational potential. Securities firms’ proprietary investments lean more toward industrial parks and energy assets, insurance capital pays closer attention to warehousing, logistics, and affordable rental housing projects, and private equity funds show strong interest in consumer infrastructure assets.

China International Fund Management (CIFM) stated that as public REITs enter a new phase of normalized issuance, the underlying asset types are becoming increasingly diverse, further clarifying the medium- to long-term allocation value of public REITs. The continued growth and maturation of this market will help enhance the role of public REITs in serving national strategies and supporting the real economy, while providing investors with more diversified investment options and long-term value.