How Much Do You Know About the Hong Kong Stock Market?

The history of the Hong Kong stock market dates back to the 19th century, boasting over a century of development.

Currently, the Hong Kong stock market has two listing segments—the Main Board and the Growth Enterprise Market (GEM). As of the end of July, there were over 2,600 listed companies in the Hong Kong market, with a total market capitalization of approximately HKD 53 trillion. Among these, Main Board companies account for about 88% in number and nearly 100% in market capitalization.

In terms of Hang Seng industry classification, the top five largest sectors by market capitalization in the Hong Kong stock market are financials, information technology, consumer discretionary, energy, and real estate & construction, collectively accounting for 76%.

Since the beginning of this year, southbound capital has shown significantly increased interest in the Hong Kong stock market. As of the end of July, the net inflow through the Stock Connect program exceeded HKD 400 billion year-to-date, three times the amount during the same period last year and surpassing the total net inflow for the entire previous year.

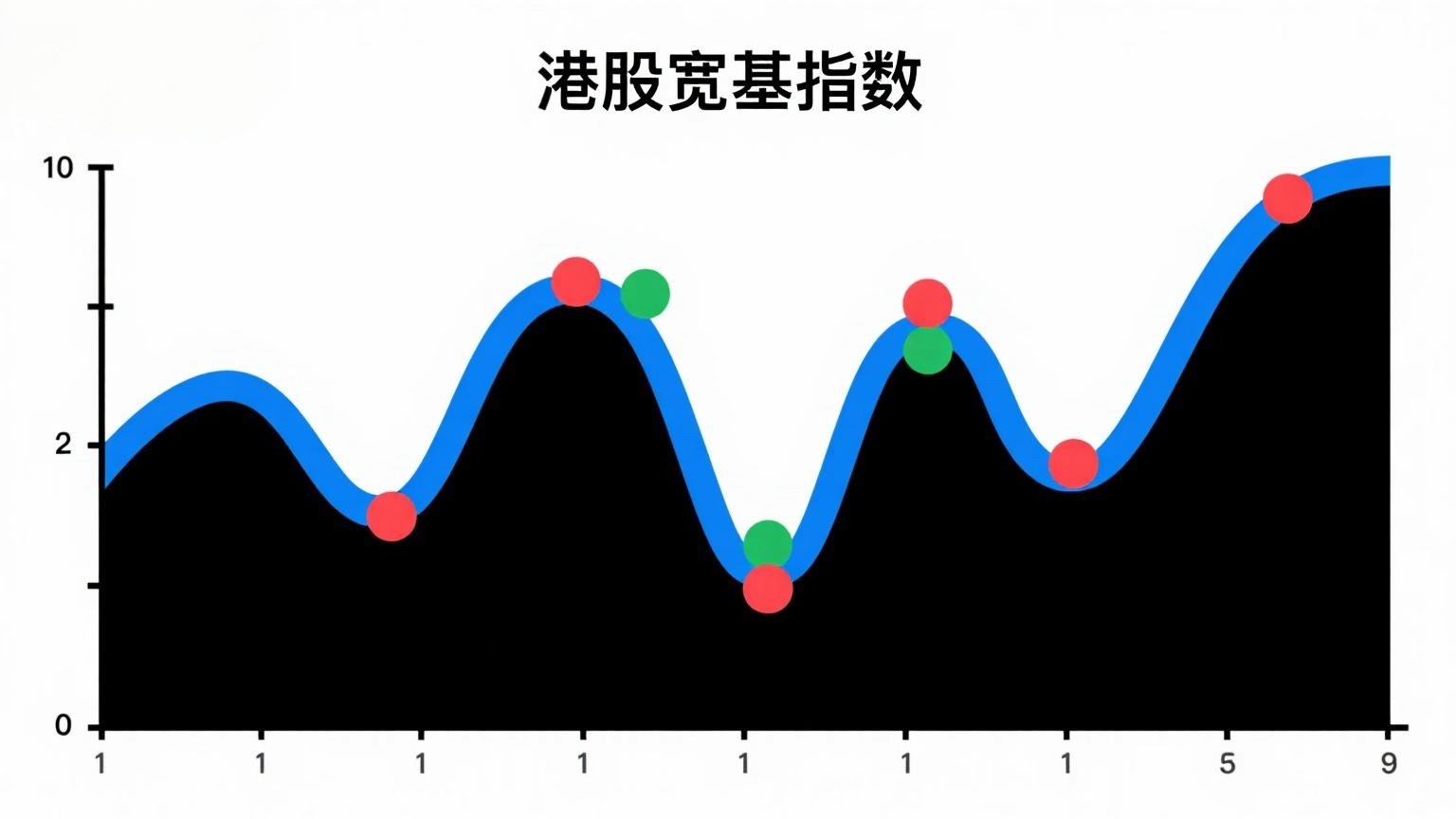

For individual investors in mainland China looking to participate in Hong Kong stock investments, ETFs tracking Hong Kong stock indices may be a convenient tool. For example, the Hang Seng Index, Hang Seng China Enterprises Index, and CSI Hong Kong Stock Connect China 100 Index are among the most widely followed broad-based indices in the Hong Kong market.

Next, we will delve into the core differences between these three indices to help you understand the investment value behind them.

All Are Hong Kong Broad-Based Indices—What Sets Them Apart?

First, the constituents of the Hang Seng Index, Hang Seng China Enterprises Index, and CSI Hong Kong Stock Connect China 100 Index are all listed on the Main Board. Specifically, the Hang Seng Index, one of the oldest stock price indices in the Hong Kong market, was launched on November 24, 1969. It includes the largest and most actively traded stocks listed in Hong Kong, emphasizing inclusivity across all sectors and the representation of companies within their respective industries, making it a key benchmark for the Hong Kong stock market.

The Hang Seng China Enterprises Index is another important broad-based index in the Hong Kong market, comprising the 50 largest and most actively traded high-quality mainland Chinese companies listed in Hong Kong. It serves as a key indicator of the overall performance of mainland Chinese companies listed in Hong Kong. Compared to the Hang Seng Index, the Hang Seng China Enterprises Index has a higher correlation with the fundamentals of mainland Chinese companies.

Another distinctive broad-based index is the CSI Hong Kong Stock Connect China 100 Index, which selects the 100 largest Chinese listed companies within the Hong Kong Stock Connect scope to reflect the overall performance of Chinese companies eligible for the program. Unlike the first two indices, the CSI Hong Kong Stock Connect China 100 Index only selects stocks within the Hong Kong Stock Connect universe.

These differences in positioning also lead to variations in market capitalization characteristics, sector distribution, and constituent stocks among the three indices.