On November 28, China Securities Index Co., Ltd. announced adjustments to the constituents of indices such as the CSI 300, CSI 500, CSI 1000, CSI A50, CSI A100, and CSI A500. This adjustment is a regular reconstitution of index constituents and will officially take effect after the market close on December 12.

Among them, this CSI A500 Index reconstitution will replace 20 constituents. Stocks like Invt, Guotai Haitong, VeriSilicon Microelectronics, Leader Harmonious Drive Systems, Compass, and Borui Bioscience will be added to the index.

It is reported that after this reconstitution, the number and weight of samples in industries such as information technology, communication services, and industrials have generally increased. The A-Series indices have a more balanced industry allocation compared to traditional broad-based indices, and the content of new quality productive forces is further enhanced, helping the indices to serve the national strategy and guide resource allocation.

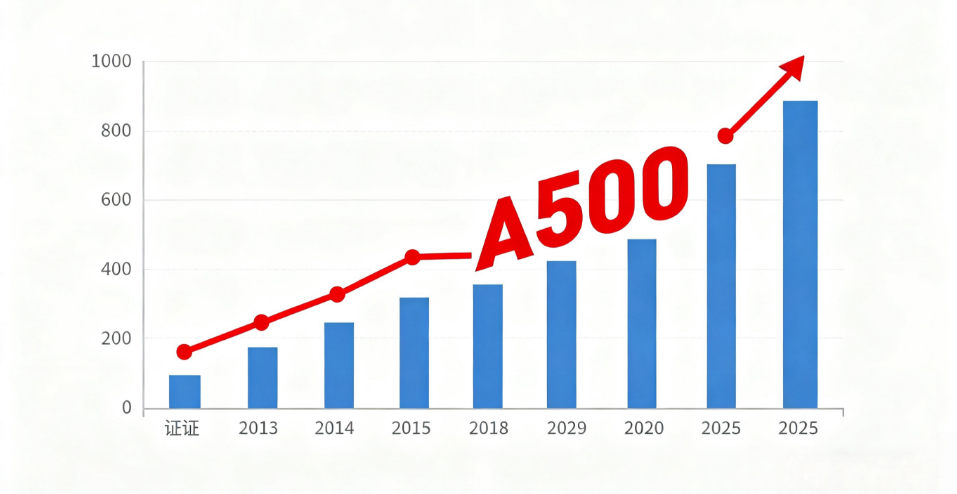

Information shows that the CSI A500 Index adopts a dual strategy of "Sector Neutral Allocation + Leading Stock Selection," covering A-share industry leaders and balancing both value and growth, representing the new generation of core A-share assets. Compared to the CSI 300, the A500 Index is overweight in sectors related to new quality productive forces such as the AI industry chain, pharmaceuticals & biotechnology, power grid equipment, new energy, and pharmaceuticals, forming a natural barbell investment structure. As of the end of the third quarter of 2025, the total market capitalization of the CSI A500 Index accounted for 52.58% of the A-share market, its operating revenue accounted for 61.82%, and its net profit accounted for 68.16%.

Capital is deploying into core indices through representative ETFs. In the past 20 days, the A500ETF Fund (512050) has accumulated net inflows of over 1.8 billion yuan. This fund has three core highlights: low fee rate (total expense ratio 0.2%), ample liquidity (average daily turnover exceeding 5 billion yuan in the past month), and leading scale (over 20 billion yuan), making it an efficient investment choice to capture the opportunity of A-share valuation uplift. Investors can pay attention to related products: A500ETF Fund (512050) [Off-platform Connector (Class A: 022430; Class C: 022431; Class Y: 022979)], A500 Enhanced ETF Fund (512370).