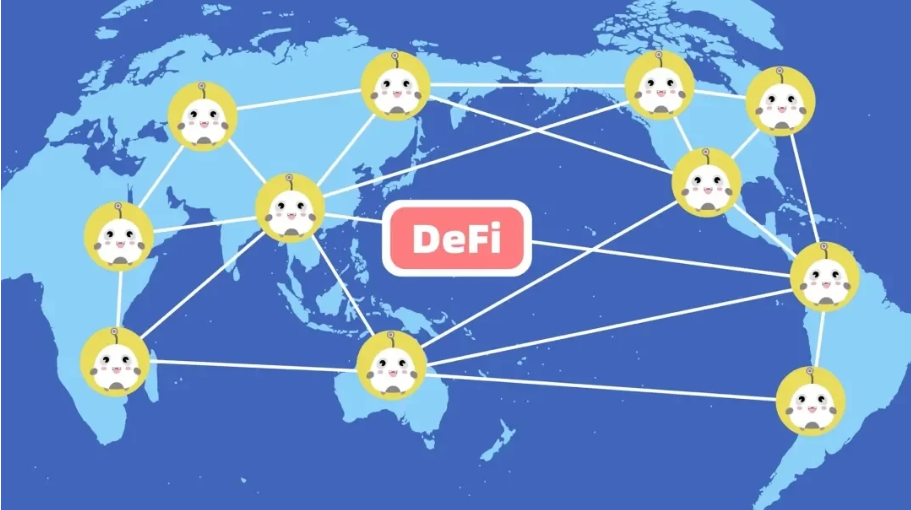

DeFi is currently a hot concept in the blockchain market. The term DeFi stands for Decentralized Finance, which refers to decentralized protocols designed to build an open financial system. Specifically, it involves creating a peer-to-peer financial system with transparency, accessibility, and inclusivity through distributed open-source protocols, minimizing trust risks and making it easier and more convenient for participants to access financing.

How to understand this? We all know that the financial services around us, such as loans, transfers, and insurance, are currently provided with third-party institutions acting as guarantors. Blockchain, being a decentralized database, can solve trust-related issues.

Thus, some have proposed removing third-party financial institutions and using technologies like blockchain and smart contracts to replace them, thereby reconstructing the traditional financial system. This ensures no centralized entity while keeping the entire system sufficiently trustworthy, with no restrictions, allowing everyone in the world to freely use financial services. Hence, the concept of DeFi was born.

Since DeFi is an umbrella term for financial concepts, it naturally includes many sub-sectors. Currently, DeFi encompasses areas such as lending, decentralized exchanges, aggregators, insurance, derivatives, and stablecoins, with lending and aggregators being the most developed.

First, let’s talk about the lending sector in DeFi. There are many lending projects in DeFi, but they all boil down to something similar to bank loans, except that the counterparty is replaced by smart contract lending protocols written in code.

For example, when we take out a loan from a bank and pledge our physical assets, the bank needs to check our credit, appraise the assets, and go through a series of processes and procedures before granting us the loan.

In the world of DeFi, the principle of lending is the same. To borrow, users need to pledge certain digital assets like Ethereum or Bitcoin, and the smart contract will release a corresponding amount of USD stablecoins as the loan. After repaying the stablecoins plus some loan interest, the system returns the collateral.

In this process, since banks are replaced by smart contract protocols written in code, tasks like asset valuation, approval, and loan disbursement are handled autonomously by smart contracts, solving issues like long processing times and cumbersome procedures in traditional lending. Moreover, because DeFi’s lending model uses over-collateralization instead of bank credit checks, it can serve more people who lack access to traditional financial services.

Second, let’s discuss aggregators, which can be likened to wealth management services in the DeFi world. In traditional finance, banks offer fixed-term deposit products where you deposit money, and if you don’t withdraw it within the specified period, the bank pays you interest, while the bank lends out the money to earn profits.

Aggregators work similarly. We can deposit our digital assets into an aggregator, which then identifies the highest-yielding lending projects in DeFi and allocates our funds across them to generate returns. The difference is that aggregators directly return the earnings from lending to us, so DeFi aggregators offer higher returns but also higher risks.

Of course, beyond lending and aggregators, the biggest difference between DeFi and traditional financial services is decentralization. Since there is no third-party institution like a bank in DeFi, each DeFi project, like Bitcoin, has its own autonomous organization where anyone can join and participate in maintaining and governing the project. Major decisions are made collectively through voting, similar to the U.S. congressional system, to determine the project’s development and changes.

In summary, DeFi is more like a reflection of the financial market in a decentralized world, carrying a hopeful vision. Since not everyone in this world can enjoy good financial services, the hope is that DeFi can ultimately create a decentralized financial world where everyone can participate.