Vicious Cycle

At present, although the unemployment rate remains near historic lows, the pace of hiring in 2025 has slowed significantly, and recent months have seen much weaker job growth than expected. The U.S. added 73,000 jobs in July, while the combined job gains for May and June were revised downward by 258,000.

Private sector employment data, though volatile, also show some concerning signs. Private sector jobs surged by 104,000 in July, but June saw a decline of 33,000 jobs—the first monthly drop in two years.

Berezin pointed out that these data are at risk of further deterioration. He stated that he expects additional downward revisions in the August employment report to be released this Friday. He said the job growth figures for May and June could be revised further.

Regarding the upcoming August employment report, he added, "If the August data is similarly weak, then I think the entire recession narrative will come back into focus."

Jonathan Millar, senior U.S. economist at Barclays, also noted that he expects bad news from the annual revision of employment data by the Bureau of Labor Statistics in September. He said the revision is likely to be significant and speculated that from April 2024 to March of this year, the U.S. economy may have added about 900,000 fewer jobs than initially reported.

"We are in a fragile zone. If the economy suffers some kind of shock, it would be easy to see the unemployment rate rising in ways that were hard to imagine a few years ago," he added. "Once the unemployment rate stops falling further, it becomes difficult to avoid a recession."

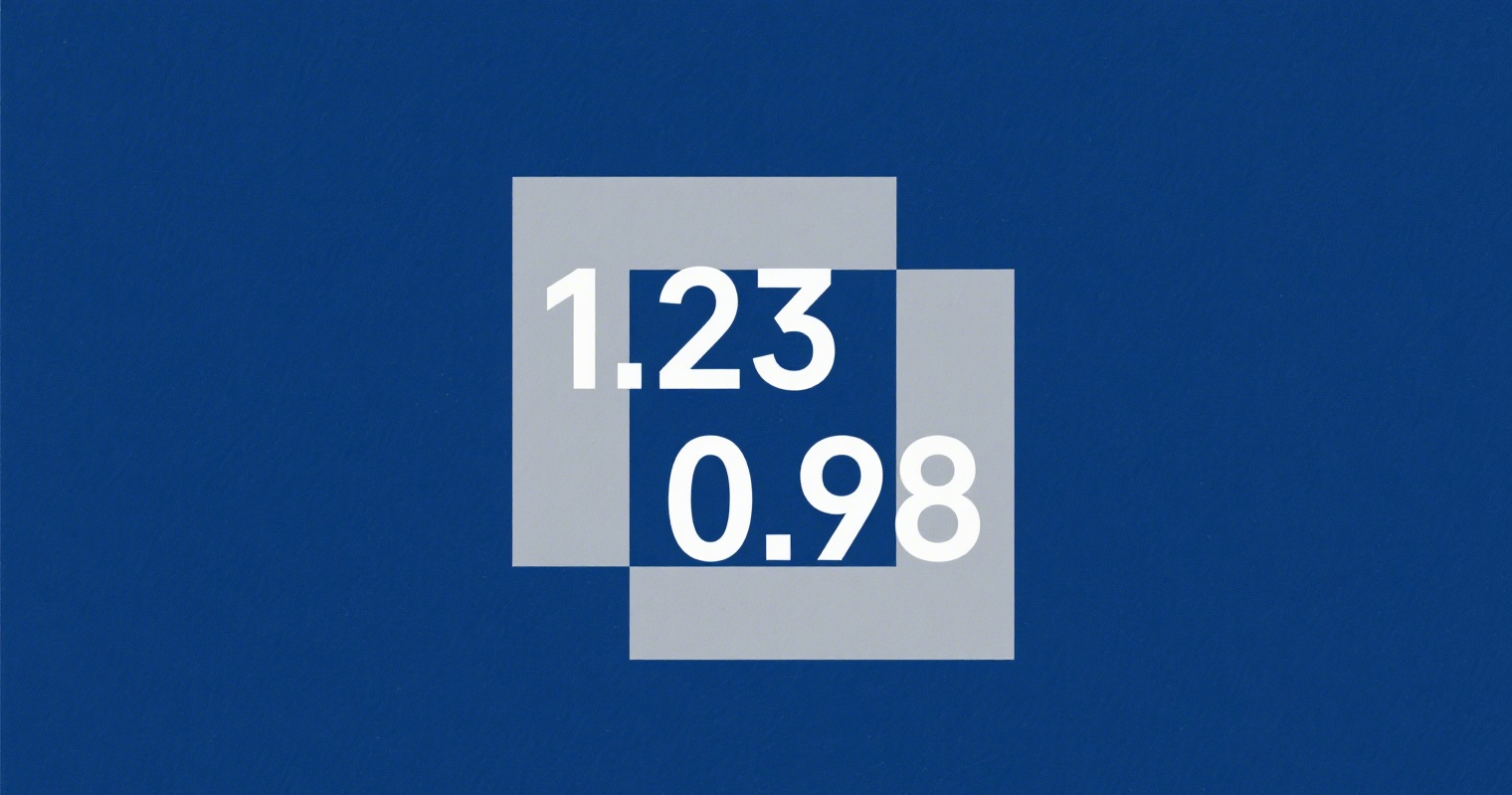

Barclays also believes that the risk of a recession has increased over the next two years. Although the bank's baseline forecast is that the U.S. will avoid a recession, its economists estimate that by mid-2026, the probability of the U.S. entering a recession exceeds 33%, and by mid-2027, this probability exceeds 50%.