Morgan Stanley Survey Reveals "Hot Trends": Cryptocurrency Adoption Still in Early Stages, More Openness to AI!

As of 2025, the phrase "we are still in the early stages" remains a popular view in the crypto community, indicating that despite Bitcoin's price exceeding $100,000, the overall adoption of digital assets is still in its infancy.

A recent survey by Morgan Stanley of financial professionals confirms this perception. The investment banking giant surveyed over 500 summer interns in North America from June 10 to 27 and 147 summer interns in Europe from June 26 to July 7.

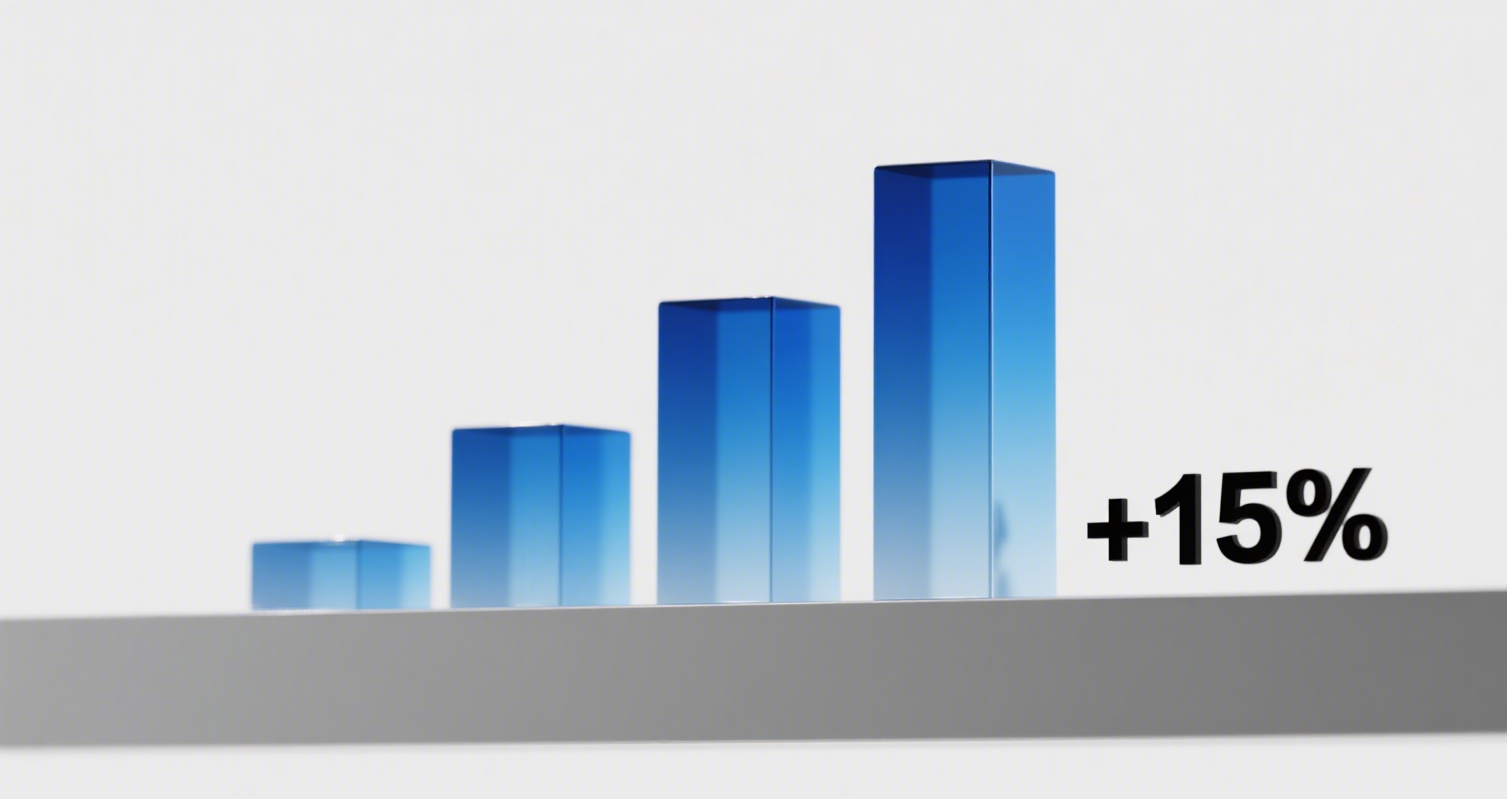

The survey revealed that only 18% of interns own or use cryptocurrencies, up from 13% last year. Meanwhile, the proportion of interns interested in digital assets rose from 23% to 26%. However, 55% still remain indifferent to digital assets, although this figure has decreased from 63% last year.

According to data from Farside Investors, since their debut in January last year, 11 spot Bitcoin ETFs have accumulated $53.7 billion in investor wealth. Ethereum ETF inflows have reached $12.4 billion. Companies are rapidly adding both assets to their balance sheets.

Bitcoin's price has surpassed $100,000 this year, securing a place in institutional investors' portfolios. Ether hit a new high of $4,800 last Friday.

The Morgan Stanley survey also showed significant adoption of artificial intelligence (AI) among future financial industry leaders, with 96% of U.S. interns and 91% of European interns reporting using AI at least occasionally.

There is unanimous agreement that AI is effective, with nearly all respondents believing AI "saves time" and is "easy to use." However, 88% of interns also noted that the technology still "needs improved accuracy."

This widespread adoption aligns with Wall Street's enthusiasm, as the "Magnificent Seven" tech giants are expected to spend $650 billion on capital expenditures and research and development this year.