With the development of blockchain technology, the cryptocurrency market has shown a trend of diversification. Stablecoins, as a special type of cryptocurrency, achieve value stability by pegging to fiat currencies or other assets, effectively addressing the issue of price volatility in crypto assets. As the internet paradigm rapidly evolves from Web2.0 to Web3.0, stablecoins have integrated technologies such as smart contracts and oracle systems, going beyond the application of blockchain technology to establish a全新的 digital asset and payment settlement system. This is having a profound impact on the reshaping of the global financial system.

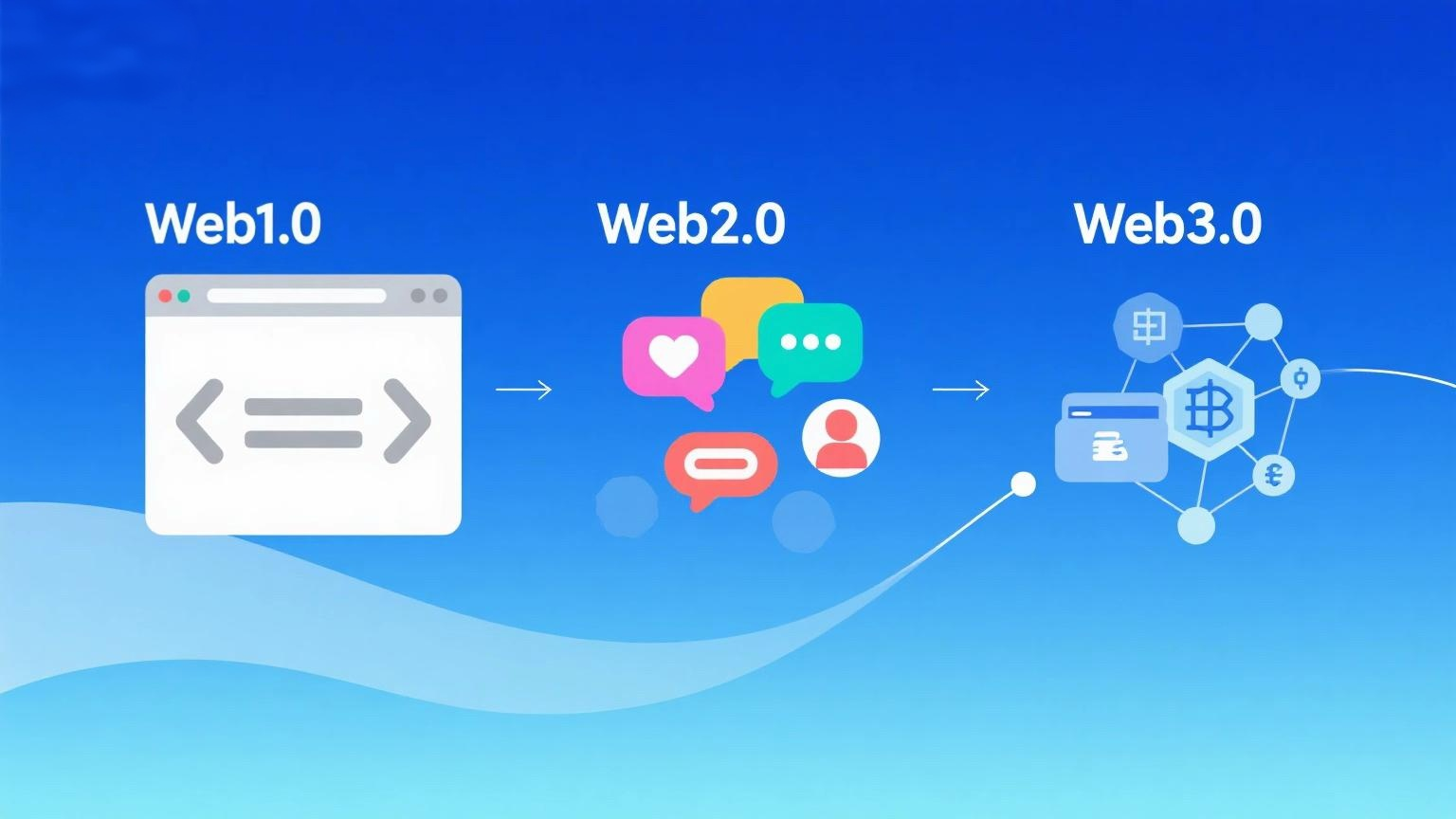

Since its inception, the internet has undergone several paradigm shifts: from the early "read-only" Web1.0 to the current "read-write" Web2.0, and now to the rapidly evolving "read-write-own" Web3.0. Each transformation has profoundly reshaped the ways information flows, users interact, and value is created. The emergence and development of stablecoins are key products of the transition from Web2.0 to Web3.0.

-

Web1.0: The Era of Internet Information Portals (Read-Only Web).

Web1.0 (mid-1990s to early 2000s) was characterized by its "read-only" nature. The internet primarily served as an information publishing platform, with website content hosted and managed by centralized servers. Content updates were infrequent, and the user experience was relatively simple. User participation was also limited, as users were mainly consumers of content with few avenues for interaction or contribution. Web1.0 laid the foundation for the popularization of the internet, but its one-way information transmission model limited user engagement and the internet's potential. -

Web2.0: The Rise of Social Interaction and the Platform Economy (Read-Write Web).

Web2.0 (mid-2000s to present) is the internet landscape we are familiar with today. Its core concepts are "user-generated content" and "social interaction." With the widespread adoption of broadband internet and the rise of mobile devices, platforms such as social media, blogs, and Wikipedia rapidly emerged, attracting vast numbers of users by offering free services. Users could freely create, share, and interact on these platforms, transitioning from mere consumers of content to producers and disseminators. Large tech companies accumulated massive amounts of user data and network effects by providing free services, forming powerful platform monopolies with absolute control over user data and content. While Web2.0 drove internet prosperity and globalization, it also exposed deep-seated issues such as excessive centralized power and lack of user data ownership, setting the stage for the rise of Web3.0. -

Web3.0: The Era of Decentralization and User Empowerment (Read-Write-Own Web).

Web3.0, which is still in its early stages and known to a minority, is the next-generation internet built on blockchain, decentralized networks, cryptographic technology, and more. Its main features include decentralization, user ownership, and the value internet, transferring control and value of the internet from centralized platforms to users and building a more open, fair, and transparent digital world. The core technologies of Web3.0 primarily include blockchain (e.g., Ethereum), smart contracts, decentralized storage (e.g., IPFS), zero-knowledge proofs, and others. Based on Web3.0 platforms, innovative applications such as DeFi (Decentralized Finance), NFT (Non-Fungible Tokens), GameFi (blockchain gaming), DAO (Decentralized Autonomous Organizations), and the metaverse are rapidly emerging, providing a platform for the rapid development of the digital economy. -

The Strong Demand for Digital Currency in the Transition from Web2.0 to Web3.0. In the traditional Web2.0 system, financial trust is achieved through institutions: banks safeguard funds, clearinghouses facilitate reconciliation, and payment platforms maintain transaction links, with users entrusting their assets to institutions for management. However, the Web3.0 world shifts from "institutional intermediary trust" to "protocol-neutral trust." Users no longer hand over their assets to intermediaries for safekeeping but instead use wallets to independently control their asset private keys. On-chain assets are transparent and visible, with contracts and algorithms replacing the roles of traditional financial institutions such as clearinghouses, payment intermediaries, and matching services. This represents a comprehensive reshaping of underlying trust and system architecture. In the Web3.0 era, digital currencies, particularly stablecoins, serve as value carriers in the decentralized world, providing a stable value foundation for the digital economy. Simultaneously, as on-chain assets, they are fully integrated into the logic of smart contracts, becoming indispensable liquid mediums for contract operation. It can be said that without digital currencies, Web3.0 would be unable to achieve truly trustless collaboration and autonomous value circulation, and the entire ecosystem would struggle to break away from the traditional financial system and move toward decentralization.