Debt Levels Remain a Concern! Fitch Maintains "AA+" Credit Rating for the U.S.

Fitch stated in a declaration that high fiscal deficits and increasing government debt levels constrain the U.S. rating. Even though revenue increases from President Donald Trump's large-scale tariff impositions are expected to reduce this year's deficit, the "AA+" rating remains unchanged.

The agency also noted, "The U.S. has not taken concrete measures to address its substantial fiscal deficits, rising debt burden, and the impending increase in expenditures related to an aging population."

At the same time, the rating agency pointed out that given the U.S.'s large high-income economy and the role of the U.S. dollar as the global reserve currency, its financing flexibility is considered.

In 2023, Fitch downgraded the U.S. sovereign rating by one notch from the previous "AAA" level, citing expectations of deteriorating fiscal conditions and ongoing repeated negotiations over the debt ceiling.

This year, another credit rating agency, Moody's, also downgraded the U.S. sovereign credit rating by one notch due to rising debt levels, meaning the U.S. has lost its last AAA rating.

Fitch's latest report stated, "Fitch's debt dynamics model indicates that medium-term debt trajectory remains upward, increasing U.S. vulnerability to future economic shocks."

Fortunately, despite rising debt levels, the U.S. dollar's 58% share in global reserves supports the U.S. government's financing capacity. Fitch stated that this means the dollar's dominance in trade and finance will persist even amid policy uncertainties.

The agency also forecasts that U.S. tariff revenue will jump to $250 billion this year, significantly higher than the $77 billion in 2024. This implies that tariff policies can alleviate fiscal issues to some extent.

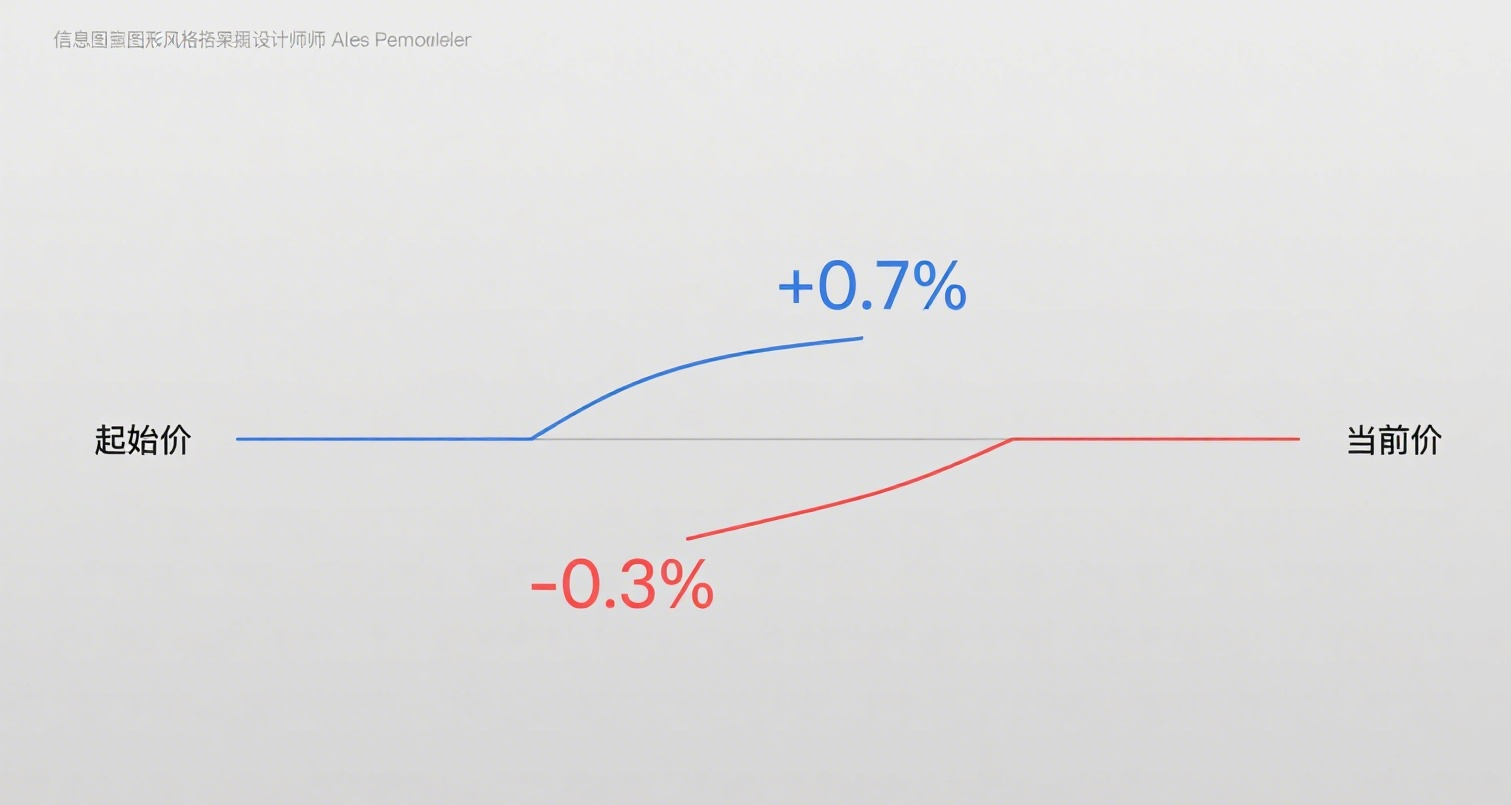

However, in the longer term, the agency expects the deficit to increase, with the debt-to-GDP ratio rising from 114.5% at the end of last year to 127% by 2027.

It is worth mentioning that earlier this month, S&P Global also maintained its "AA+/A-1+" credit rating for the U.S., stating that the outlook for the U.S. credit rating remains stable. The reason cited is that the tariff policies implemented by Trump can, to some extent, fill the fiscal "gap" caused by recent tax cuts and spending bills.