Wall Street on High Alert: Powell’s Final Jackson Hole Speech May Deliver a "Strong Shock"!

Financial markets are holding their breath ahead of Powell’s eighth and final Jackson Hole keynote speech as Fed Chair. Many Wall Street traders say that if the market reactions following Powell’s past seven Jackson Hole speeches are any indication, investors may need to brace for a bumpy ride.

Fed watchers will closely monitor whether Powell signals a willingness to cut interest rates at the Fed’s September 16-17 meeting. Over the past few months, Powell’s public remarks have been relatively hawkish, though these speeches all occurred before the weak July employment data was released—a report that fully ignited market expectations for easing.

The latest pricing in the interest rate futures market shows traders assign an 85% probability of a 25-basis-point rate cut by the Fed next month, with an additional 25-basis-point cut expected by year-end. Powell’s speech on Friday is expected to largely clarify whether these positions will "make money"—that is, whether the rate cut bets are correct.

Given that traders have placed such "heavy bets" on imminent policy easing, if Powell sticks to the "ambiguous" stance that Fed policymakers need to see more upcoming data before deciding whether to restart the easing cycle, it will undoubtedly plunge the market into "painful trades."

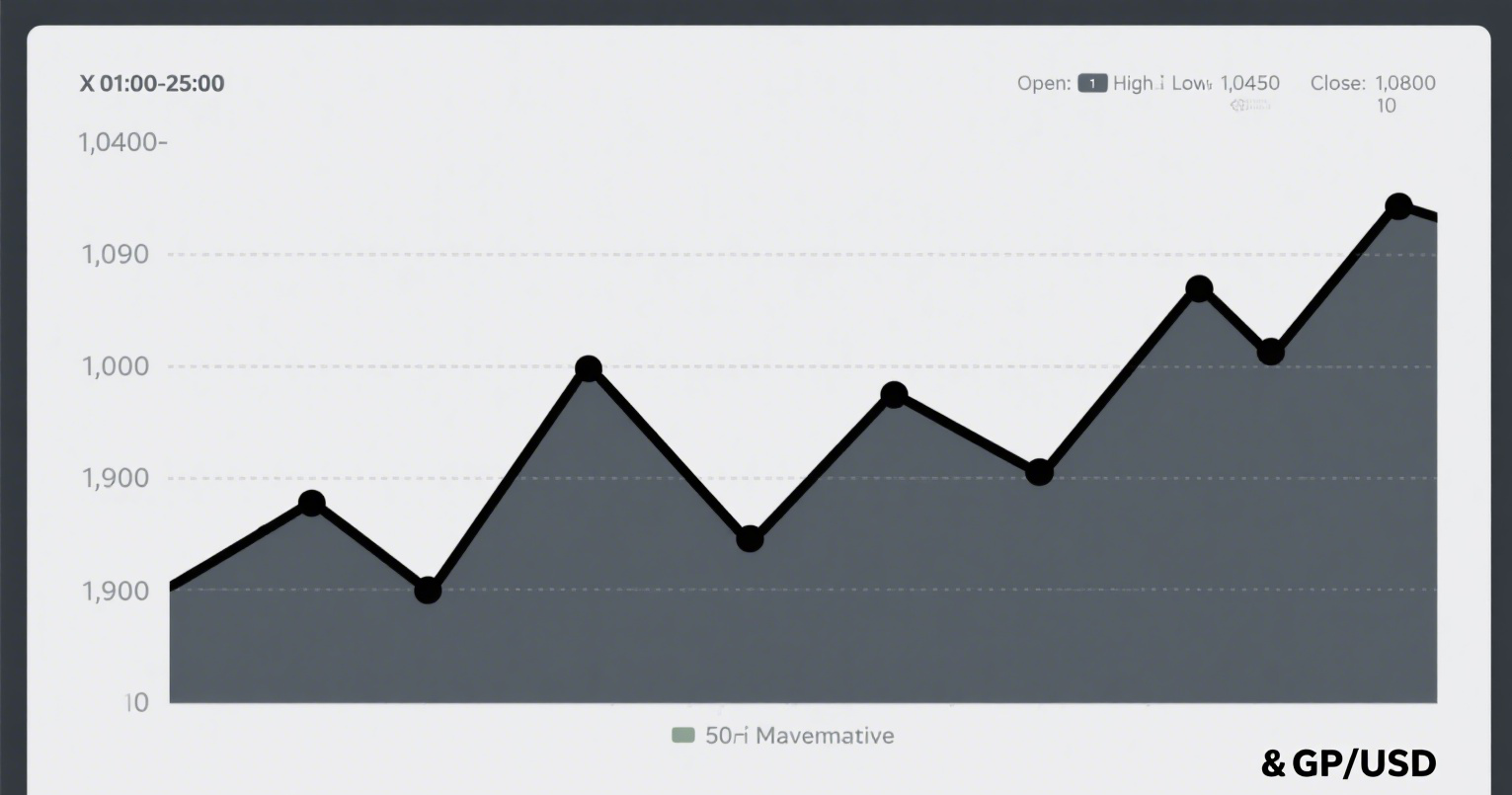

Investors clearly have reason to be cautious—history shows that Powell’s Jackson Hole speeches have often significantly shaken markets, especially the bond market.

Moreover, although Powell is generally considered a policy dove at heart, his carefully prepared Jackson Hole speeches have tended to push U.S. Treasury yields higher, not lower.