Tariffs and Exchange Rates Hit Auto Parts Industry! Economic Minister Proposes 6 Countermeasures

Former U.S. President Trump recently announced a 20% tariff on Taiwan, but reports now indicate this rate is "additive"—meaning it will be imposed on top of existing Most Favored Nation (MFN) rates. This, combined with exchange rate risks, has dealt a heavy blow to Taiwan's auto parts industry. Economic Minister Kuo Jyh-Huei today (11th) proposed six countermeasures, including reviewing commodity tax policies and introducing smart manufacturing and AI technologies, to help the industry weather the impact.

Kuo convened a "Forum on the Impact of U.S. Tariff Hikes on the Auto Parts Industry," inviting major AM export and domestic OE supply chain manufacturers to discuss U.S.-Taiwan tariffs and NT dollar exchange rate issues, gathering industry feedback.

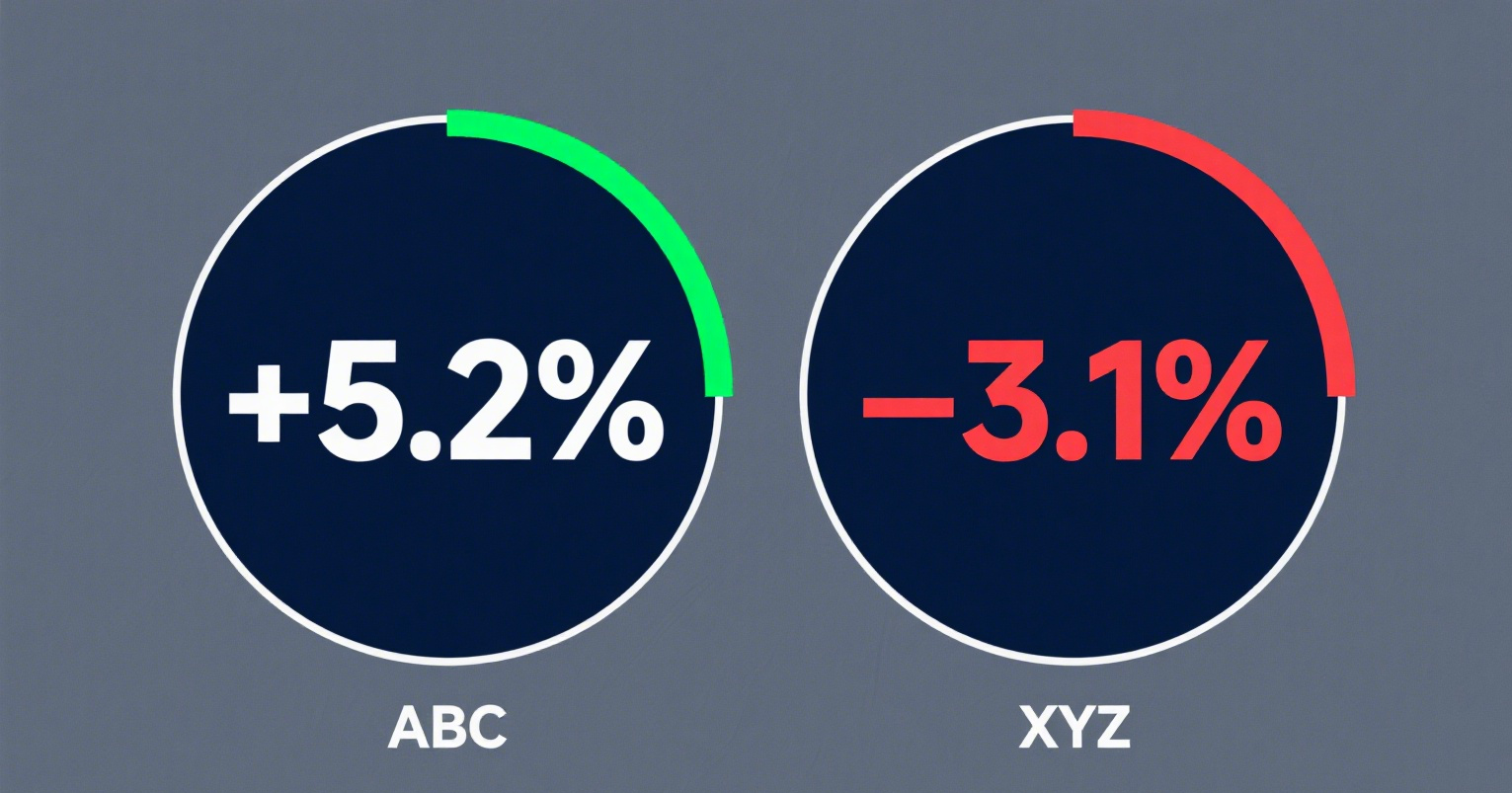

Addressing temporary tariffs and exchange rate volatility, Kuo noted the government is actively negotiating with the U.S. for more favorable rates to enhance the competitiveness of Taiwan's auto parts in global trade and maintain their leading export position. Taiwan has ~1,741 auto parts manufacturers, with exports exceeding NT$220 billion annually over the past three years—half of which goes to the U.S. The industry is highly sensitive to tariff and exchange rate fluctuations, which directly affect profitability and operational performance.

Most attendees highlighted that Japanese and Korean auto parts enjoy 15% tariff rates for U.S. exports and urged Taiwan to push for lower tariffs. They also called for stable electricity prices and exchange rates amid rising costs (energy, materials) and weak domestic demand, alongside legal reforms for repair exemptions aligned with global trends. Expanding domestic demand was emphasized to sustain industry competitiveness.

Kuo outlined six countermeasures for the auto parts sector:

-

Adopt smart manufacturing and AI to boost production efficiency and reduce defect rates.

-

Promote equipment upgrades via replacement policies to cut carbon emissions and long-term costs, fostering sustainability.

-

Centralize raw material procurement to strengthen bargaining power, with the ministry assisting China Steel in cost reductions to benefit downstream firms.

-

Boost innovation support, raising R&D tax credits and streamlining subsidies to incentivize transformation.

-

Review commodity tax policies to phase out old vehicles and stimulate domestic demand.

-

Provide hedging credit guarantees for SMEs to mitigate exchange rate risks.

Kuo stressed that the fast-changing global trade environment demands swift, multifaceted dialogue to gather frontline insights and craft precise, impactful policies—turning challenges into opportunities to strengthen resilience and elevate Taiwan's auto industry globally.