Enhancing the Benchmark Role of the Central Parity Rate

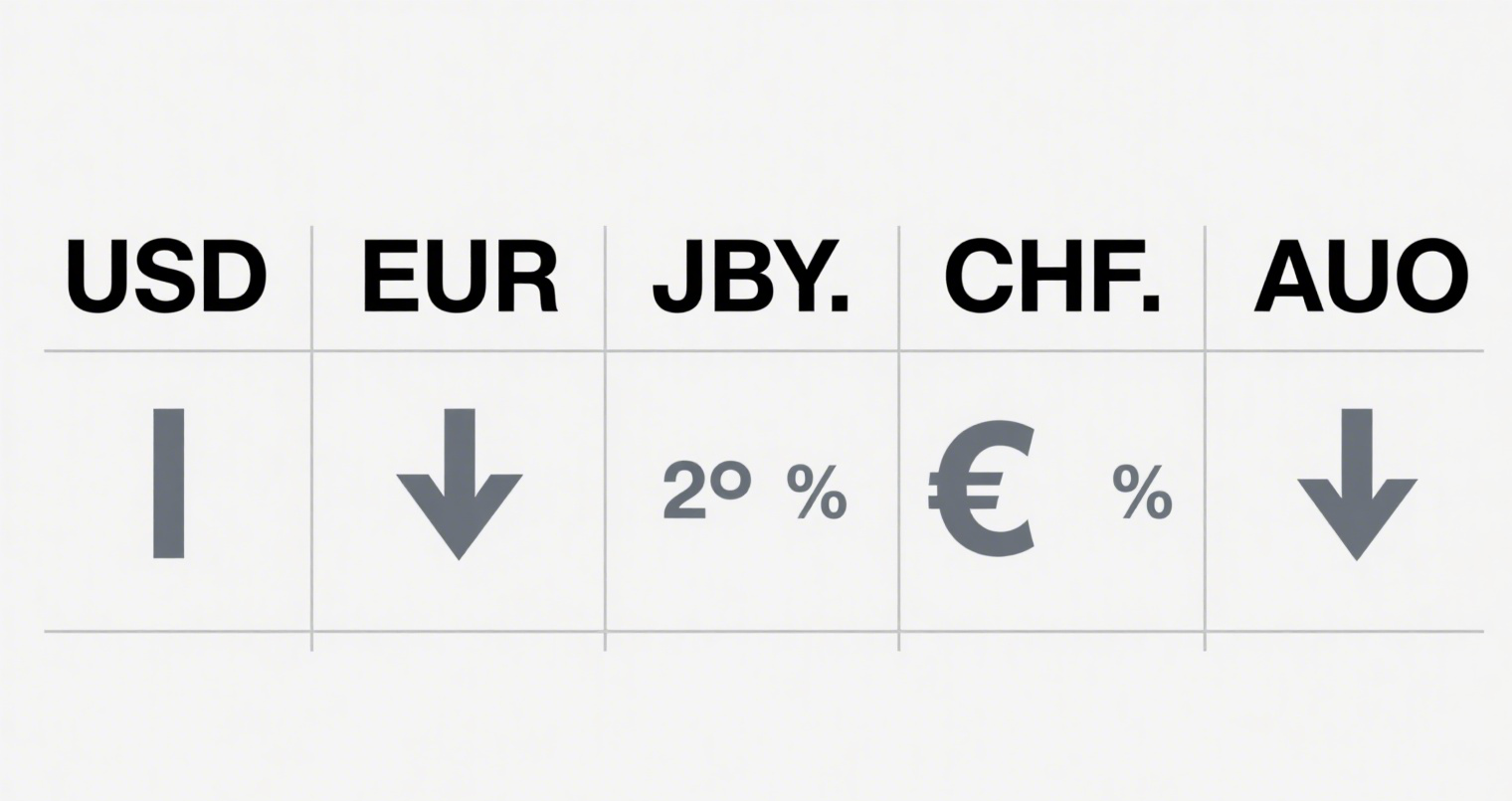

Rewinding to the period before the "August 11 Exchange Rate Reform," the international economic and financial landscape was complex. The U.S. economy was in recovery, and market expectations of a Fed rate hike within the year drove the U.S. dollar stronger, while the euro and yen weakened. Currencies of some emerging economies and commodity-producing nations depreciated, and international capital flows became more volatile, creating new challenges.

China maintained a large trade surplus, and the RMB’s real effective exchange rate was relatively strong compared to many global currencies, deviating from market expectations. According to the Bank for International Settlements (BIS), from July 2014 to July 2015, the RMB’s nominal and real effective exchange rates appreciated by 11.6% and 11.3%, respectively.

Since the 2005 exchange rate mechanism reform, the RMB central parity rate, as a benchmark, had played a crucial role in guiding market expectations and stabilizing exchange rates. However, during this period, the central parity rate significantly and persistently deviated from the market rate, undermining its benchmark status and authority.

To prevent excessive imbalances from accumulating, adjustments were needed to enhance the market orientation and benchmark role of the central parity rate, leading to the "August 11 Reform." On August 11, 2015, the People’s Bank of China (PBoC) announced improvements to the central parity rate mechanism for the RMB against the U.S. dollar to increase its market-driven nature and reliability. From that day onward, market makers were required to submit their central parity quotes to the China Foreign Exchange Trade System (CFETS) before the interbank market opened each day, referencing the previous day’s closing rate while considering supply and demand conditions and changes in major international currencies.

In its Q3 2015 Monetary Policy Report, the PBoC stated that this reform strengthened the decisive role of market forces in exchange rate formation, improved the market orientation of the central parity rate, and allowed market-driven adjustments to guide the RMB toward a more balanced level. The deviation between the central parity rate and the market rate was corrected, significantly enhancing the benchmark role of the central parity.

Wang Youxin, Director of the Bank of China Research Institute, told the Securities Daily that the core achievement of the "August 11 Reform" was restructuring the underlying logic of the RMB exchange rate formation mechanism, shifting from a "rigid peg" to "flexible, market-driven pricing," and continuously unleashing institutional dividends through market-oriented reforms.