The Market-Oriented Level Continues to Improve

Since the "August 11 Exchange Rate Reform," the central bank has continuously improved the managed floating exchange rate system based on market supply and demand, with reference to a basket of currencies. The market-oriented level of the RMB exchange rate has been steadily increasing.

Wang Qing, chief macro analyst at Oriental Jincheng, told the Securities Daily that over the past decade, the RMB exchange rate has experienced both appreciation and depreciation, with significantly increased two-way fluctuation flexibility, better serving as an automatic stabilizer for macroeconomic and balance-of-payments adjustments. Meanwhile, regulators have continuously enriched the foreign exchange market regulation toolkit, effectively curbing the risk of RMB exchange rate overshooting and guiding the RMB exchange rate to remain basically stable at a reasonable and balanced level. This is of great significance in effectively resisting various external shocks and safeguarding financial security.

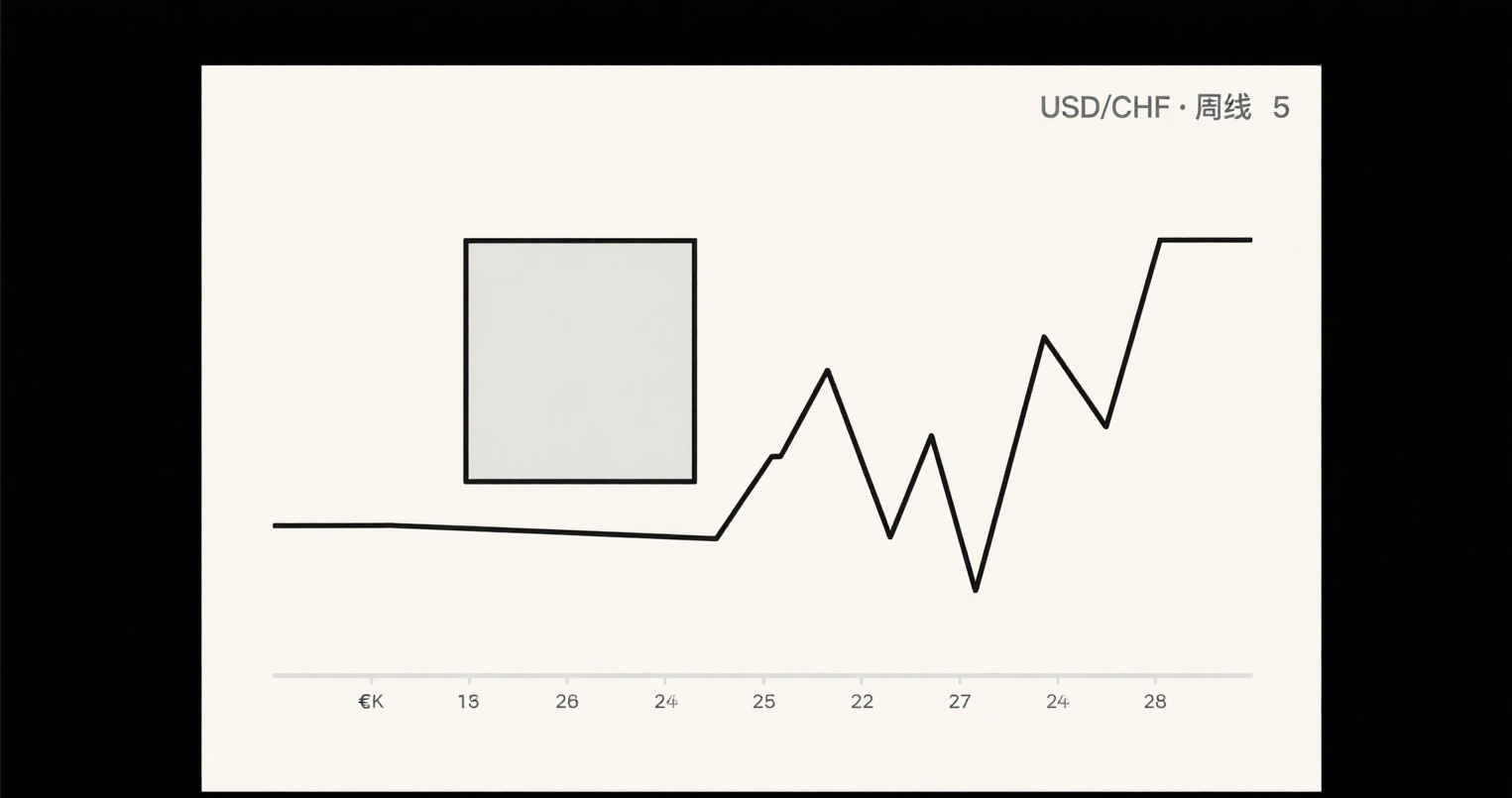

According to the latest data, the central bank's Q1 2025 China Monetary Policy Implementation Report, released in May this year, showed that in Q1, the RMB's central parity rate against the U.S. dollar ranged from a high of 7.1688 to a low of 7.1891. Among the 57 trading days, the RMB appreciated on 28 days and depreciated on 29 days. The maximum single-day appreciation was 0.26% (183 pips), while the maximum single-day depreciation was 0.08% (57 pips). The RMB exchange rate against major international currencies fluctuated both ways, appreciating against some and depreciating against others. By the end of March, the RMB's central parity rate against the U.S. dollar, euro, British pound, and Japanese yen had appreciated by 0.14%, depreciated by 3.5%, depreciated by 2.6%, and depreciated by 4.4%, respectively, compared with the end of the previous year.

Wang Youxin stated that since the "August 11 Exchange Rate Reform," exchange rate flexibility has significantly increased, and two-way fluctuations have become the norm. After this reform, the RMB exchange rate broke free from one-sided expectations of appreciation or depreciation. Enhanced exchange rate flexibility has avoided the impact of exchange rate overshooting on the real economy. At the same time, the market-oriented level of the exchange rate formation mechanism has improved. RMB exchange rate adjustments now better reflect real market demand, promptly reflect changes in domestic economic fundamentals, and are less affected by the U.S. dollar and external factors.

"Since the beginning of this year, amid drastic changes in the external environment and severe fluctuations in the global foreign exchange market, the resilience of the RMB exchange rate has exceeded general market expectations. While appreciating slightly against the U.S. dollar, the three major RMB basket exchange rate indices, including CFETS, have remained largely stable," Wang Qing analyzed. He noted that domestically, strengthened unconventional countercyclical adjustments and more proactive macro policies have supported steady and improving macroeconomic conditions, providing crucial internal support for the RMB exchange rate. In the short term, the RMB exchange rate against the U.S. dollar will remain stable with a slight strengthening bias. The main direction for future reforms to deepen the marketization of the RMB exchange rate is to moderately increase its flexibility, promptly release appreciation and depreciation pressures, and more fully leverage its role as a macroeconomic stabilizer.