What Does Counter-Cyclical Adjustment Mean?

What is counter-cyclical adjustment, and how is it implemented?

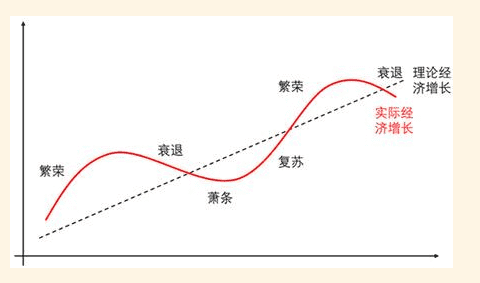

Under market economy conditions, any economic model develops amid fluctuations. These fluctuations constitute the economic cycle, which goes through periodic phases of recovery, prosperity, recession, and depression.

"Counter-cyclical adjustment" refers to the government's use of policy tools and measures to smooth out the volatility of the economic cycle and mitigate negative impacts. So, what "tools" are available in this year's fiscal policy toolkit?

-

Fiscal Deficit Spending

A fiscal deficit occurs when the government's total revenue (e.g., taxes, fines) is less than its total expenditures (e.g., public services, infrastructure, social security). The government spends more than it earns to stimulate economic growth, especially during downturns, by increasing public spending to boost demand. -

Special Bonds

Special bonds are debt instruments issued by the government for specific projects or purposes, such as infrastructure construction or public services. This year, the new local government special bond quota is 3.9 trillion yuan, an increase of 100 billion yuan from last year. From January to August, 2.58 trillion yuan has been issued. -

Ultra-Long-Term Special Treasury Bonds

In May, the Ministry of Finance announced plans to issue 1 trillion yuan in ultra-long-term special treasury bonds, primarily to stimulate current economic growth and lay the foundation for long-term industrial restructuring and upgrading. So far, 802 billion yuan has been issued. -

Tax Incentives

Policies such as structural tax cuts and fee reductions continue to be implemented, including R&D expense super-deductions, VAT additional deductions for advanced manufacturing enterprises, and tax breaks for technological achievements. From January to August, tax cuts, fee reductions, and rebates supporting technological innovation and manufacturing development exceeded 1.8 trillion yuan. -

Fiscal Subsidies

This year, the central government allocated 66.7 billion yuan in employment subsidies, and national education expenditures reached 3 trillion yuan from January to September. Additionally, the minimum standard for basic pensions for urban and rural residents was significantly raised to improve livelihoods.

At a State Council Information Office press conference on October 12, officials discussed "strengthening counter-cyclical fiscal policy adjustments to promote high-quality economic development" and announced several incremental policies:

-

Supporting local governments in resolving debt risks to free up fiscal space for development and livelihood protection.

-

Issuing special treasury bonds to help major state-owned banks replenish Tier 1 capital and better serve the real economy.

-

Combining special local government bonds, funding, and tax policies to stabilize the real estate market.

-

Strengthening support for key groups, including one-time living subsidies for low-income households and incentives to boost overall consumption.

Furthermore, Lan Fo'an emphasized that other policy tools are under study, and the central government still has room for increased borrowing and deficit expansion. As these policies take effect, will the A-share market see a sustained rally? While supportive policies have boosted market sentiment, their sustainability depends on short-term economic data and corporate fundamentals.