Understanding the Factors Behind Gold Price Fluctuations!

As one of the most closely watched assets in global financial markets, gold prices are heavily influenced by supply and demand dynamics. Below, we delve deeper into how these factors shape gold's price trends and highlight key market drivers.

Supply & Demand: The Balancing Act of the Gold Market

The equilibrium between supply and demand is a core determinant of gold prices.

-

Supply Side: Gold supply is affected by mining output, recycling volumes, and central bank reserves.

-

Demand Side: Investment demand, jewelry consumption, and industrial usage all contribute to demand fluctuations.

When this balance shifts, gold prices adjust accordingly. Oversupply may depress prices, while shortages can drive them higher. Thus, investors must monitor these dynamics to identify trends and make informed decisions.

Key Drivers: Capturing Opportunities in the Gold Market

Beyond supply and demand, the following factors significantly impact gold price movements:

-

Global Economic Conditions:

Economic growth prospects and stability directly affect gold. Recessions, financial crises, or heightened geopolitical risks typically boost safe-haven demand, lifting prices. -

Monetary Policy & Inflation Expectations:

Central bank policies (e.g., rate cuts or quantitative easing) and inflation outlooks are critical. Loose policies and high inflation expectations often increase gold demand, pushing prices up. -

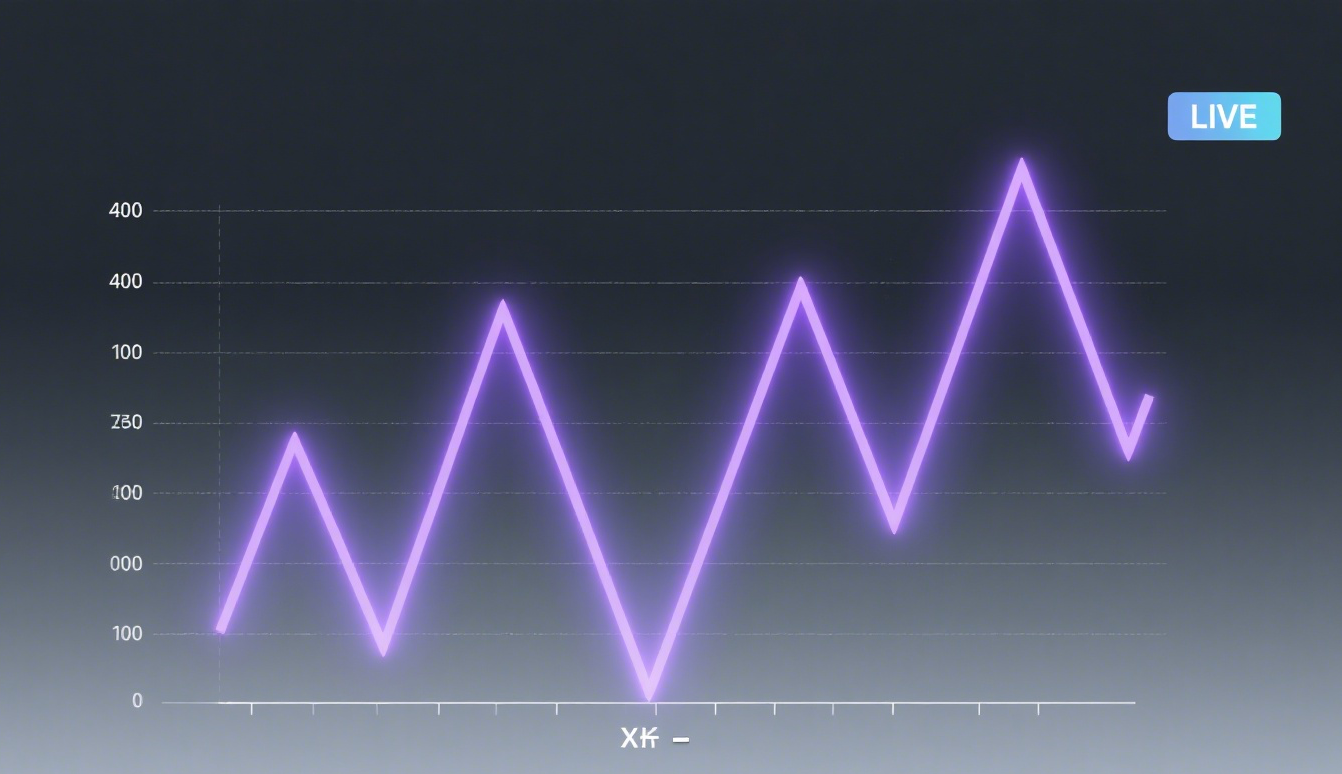

Technical Analysis:

Traders frequently use tools like trendlines, moving averages, and the Relative Strength Index (RSI) to predict price trends and identify entry/exit signals.