Key Points

A dusting attack is a malicious act where hackers and scammers send tiny amounts of cryptocurrency to users' wallets in an attempt to compromise the anonymity of their Bitcoin and other crypto holdings. Subsequently, the hackers and scammers track the transaction activities of the targeted wallets, conducting comprehensive analyses of various addresses to try to de-anonymize the individuals or companies behind the wallet addresses.

What is Dust?

In cryptocurrency terminology, "dust" refers to tiny amounts of coins or tokens that are often overlooked due to their negligible value. For Bitcoin, the smallest unit is 1 satoshi, which is 0.00000001 BTC. The term "dust" can refer to a few hundred satoshis.

On cryptocurrency exchanges, dust can also refer to the small amounts of coins "left over" in a user's account after executing a trade order.

Bitcoin does not officially define the concept of "dust" because different software implementations (or clients) may set different dust thresholds. Bitcoin Core defines dust as any transaction output below the cost of the transaction fee, which introduces the concept of a "dust limit."

Technically, the dust limit is calculated based on the inputs and outputs of a transaction. For standard Bitcoin transactions (non-SegWit), the result is typically 546 satoshis, while for native SegWit transactions, it is usually 294 satoshis. This means any standard transaction output of 546 satoshis or less is considered spam and may be rejected by validating nodes.

Detailed Explanation of Dusting Attacks

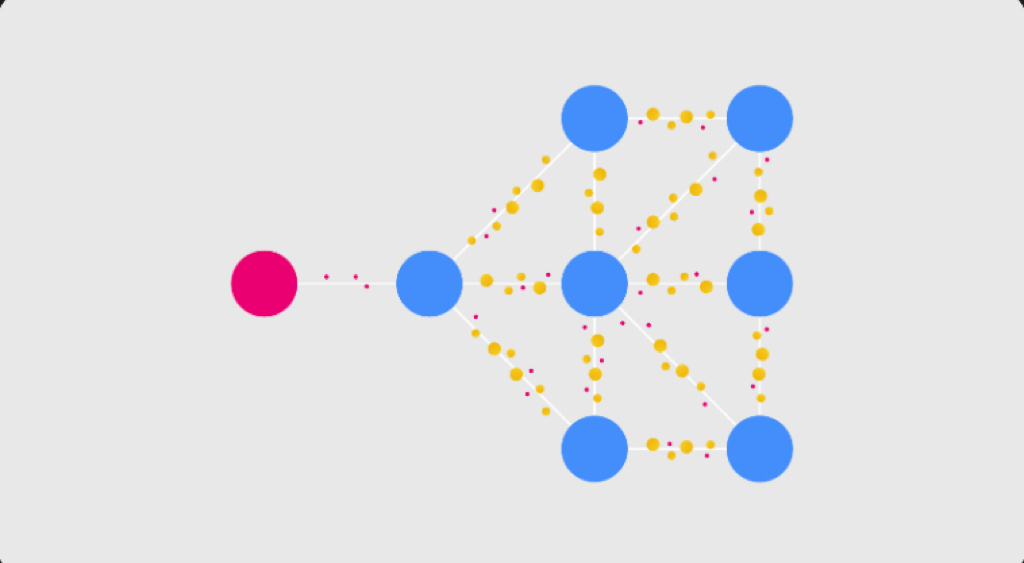

Malicious actors have realized that cryptocurrency users often do not pay much attention to these tiny amounts appearing in their wallet addresses. As a result, they send small amounts of satoshis to "dust" a large number of addresses (i.e., small amounts of LTC, BTC, or other cryptocurrencies). After dusting multiple addresses, the next step in a dusting attack is to perform a comprehensive analysis of these addresses to determine which ones may belong to the same wallet.

The ultimate goal of the attack is to link these dusted addresses and wallets to their respective companies or individuals. Once successful, the attackers can use this information to target the victims with carefully crafted phishing schemes or extortion threats.

Dusting attacks were initially carried out on the Bitcoin network, but Litecoin (LTC), Binance Coin (BNB), and other cryptocurrencies are equally susceptible. This is possible because most cryptocurrencies operate on traceable public blockchains.

Dusting attacks primarily rely on comprehensive analyses of multiple addresses. Therefore, if the dusted funds remain untouched, the attackers cannot establish the connections needed to de-anonymize the wallet. Some wallets can now automatically flag suspicious transactions for users. Although the dust limit is 546 satoshis, many dusting attacks exceed this amount, typically ranging from 1,000 to 5,000 satoshis.

Bitcoin's Anonymity

Bitcoin is an open, decentralized asset where anyone can create a wallet and join the network without providing personal information. While all Bitcoin transactions are publicly visible, identifying the individuals behind each address or transaction is not straightforward, which is why Bitcoin maintains a degree of anonymity (though not complete).

Peer-to-peer (P2P) transactions are more likely to remain anonymous because they do not require intermediaries. However, many cryptocurrency exchanges collect personal data during Know Your Customer (KYC) procedures. When users transfer funds between personal wallets and exchange accounts, they risk losing their anonymity. Ideally, a new Bitcoin address should be created for each new receiving transaction or payment request. Creating new addresses helps protect user privacy.

It is worth noting that, contrary to popular belief, Bitcoin is not a truly anonymous cryptocurrency. Beyond dusting attacks, many companies, research labs, and government agencies conduct blockchain analyses to de-anonymize blockchain networks.

Conclusion

While the Bitcoin blockchain is nearly impossible to hack or compromise, wallets remain a focal point of concern. Typically, you do not provide personal information when creating a new wallet or address. If a hacker gains access to your tokens, you cannot prove it was theft—and even if you could, it wouldn’t help.

Holding cryptocurrency in a personal wallet is akin to being your own bank. If your wallet is hacked or you lose your private key, there is nothing you can do.

The growing value of privacy and security benefits everyone, not just those seeking to hide their tracks. This is especially important for cryptocurrency traders and investors.

Beyond dusting and other de-anonymization attacks, it is crucial to remain vigilant against other security threats in the cryptocurrency space, such as cryptojacking, ransomware, and phishing. Strengthening security measures includes installing reliable antivirus software on all devices, encrypting wallets, and storing keys in encrypted folders.