Late-Session Unusual Movements: Causes and Precautions

Late-session price anomalies fall into two types:

-

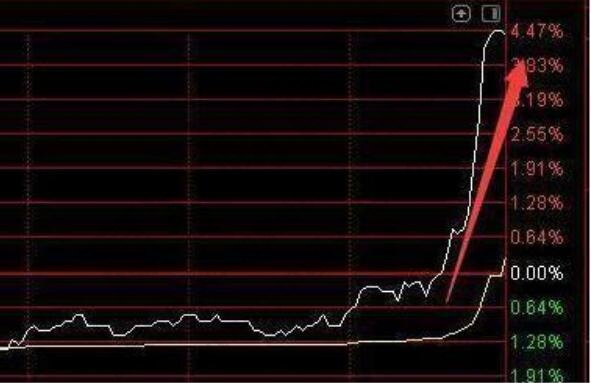

Late Rally: A stock/index trades normally but surges near the close due to large buy orders.

-

Late Sell-off: A stock/index drops sharply at the close due to heavy sell orders.

Investors often wonder why such movements occur. Key reasons include:

Causes of Late Rallies

-

Breaking Good News: Positive announcements trigger last-minute buying.

-

Main Force Accumulation: Big players mark up prices after completing low-cost position building.

-

Distribution at Highs: Manipulative pumps to lure retail buyers before dumping shares.

Causes of Late Sell-offs

-

Stealth Accumulation: Suppressing prices to avoid drawing attention during accumulation.

-

Shaking Out Weak Hands: Forcing profit-takers to sell for easier future markup.

-

Setting Up Next Day: Lower close allows cheaper entry points next morning.

Investor Guidelines

-

Screen stocks using late-session gainers list, but filter out small-order fake pumps.

-

Avoid stocks that rally only at the close after flat daily trading (potential traps).

-

Steer clear of heavily manipulated stocks with dominant controlling forces.

Whether late pumps or dumps, always analyze multiple factors—market context, fund flows, and fundamentals—before trading decisions.