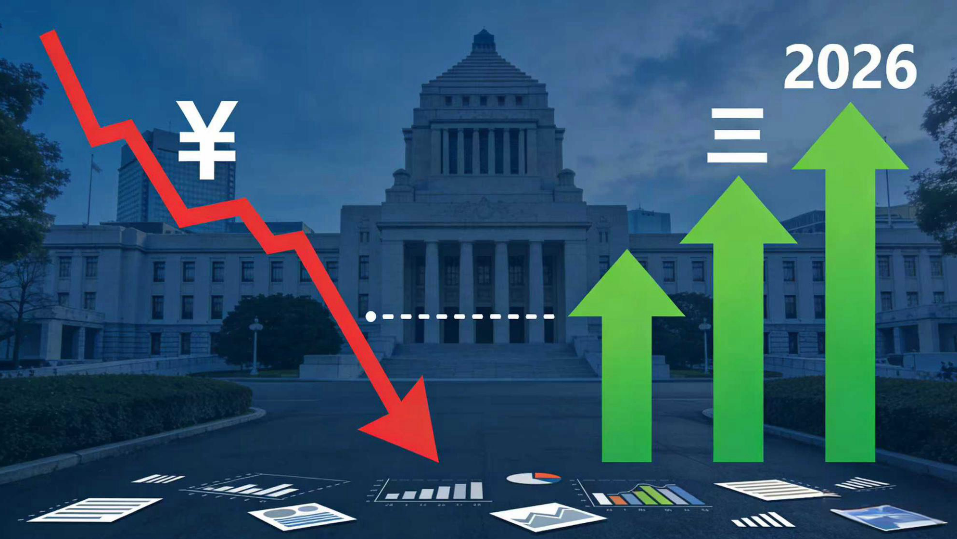

On January 20, Akira Hoshino, head of Citigroup's Japan market operations, stated that if the yen continues to weaken, the Bank of Japan may raise interest rates three times this year, doubling the current interest rate level. In an interview, Hoshino said that if the USD/JPY exchange rate breaks through 160, the Bank of Japan may raise the unsecured overnight call rate by 25 basis points to 1% in April.

He believes that if the yen remains at low levels, a second rate hike of the same magnitude could occur in July, and possibly even a third hike before the end of the year. "Simply put, the yen's weakness is driven by negative real interest rates," Hoshino said. "If [the Bank of Japan] wants to reverse the trend of the exchange rate, it has no choice but to address this issue." Currently, Hoshino expects the yen to fluctuate within a range slightly below 150 to 165 this year.