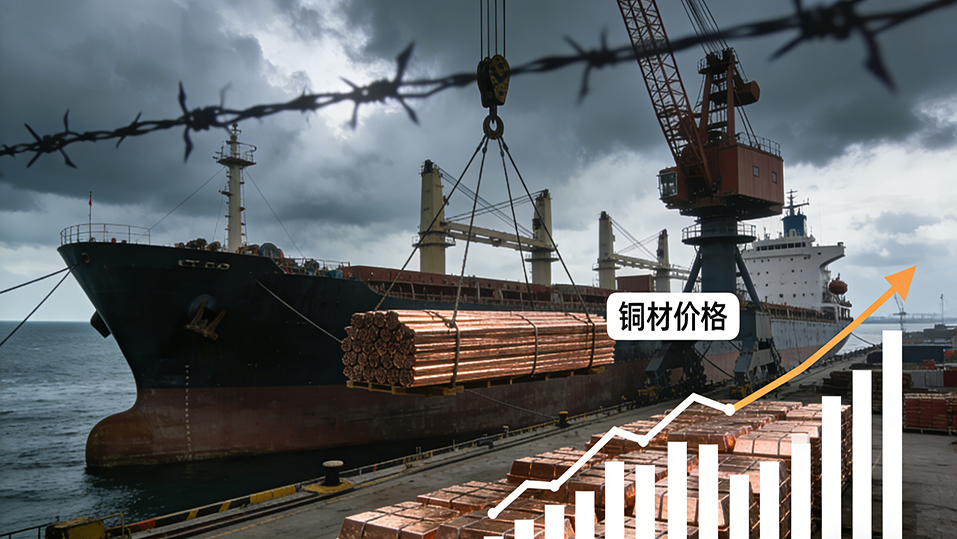

It is reported that copper prices have surged, approaching record highs, driven by concerns over tightening supply in the new year and overall market risk appetite.

London benchmark copper futures rose by approximately 3%, nearing the peak of slightly below $13,000 per ton set last week. Concerns over potential U.S. tariffs have prompted traders to accelerate shipments to the country, leading to tighter supply conditions in other regions. Additionally, the onset of a strike at Chile’s Mantoverde mine has highlighted supply risks amid expanding global demand.

All base metals strengthened on Monday, while Asian stocks hit record highs, boosted by gains in technology shares. More broadly, investors are assessing the wider implications of the U.S. arrest of Venezuelan leader Nicolás Maduro over the weekend, including the evolving U.S. stance on core resources tied to security and economic growth.

Copper, which is critical for both the energy transition and traditional uses, soared 42% in 2025, marking its best annual performance since 2009. Concerns over potential U.S. import tariffs have already led to increased inventories tracked by U.S. exchanges. At the same time, the cash-to-three-month spread for copper on the London Metal Exchange remains firmly in backwardation, a pattern indicating near-term supply tightness.

"Overall supply shortages, combined with regional mismatches caused by U.S. tariffs, are driving copper prices higher," analysts wrote in a report. "The global copper market is expected to face a deficit of over 100,000 tons in 2026."

The three-month copper contract on the London Metal Exchange rose by 3% at one point to $12,839 per ton; as of press time, it was trading at $12,838 per ton. Among other metals, aluminum prices climbed 1.8% to $3,069 per ton, reaching their highest level since April 2022, driven by tightening supply prospects and expectations for long-term demand.

Additionally, Singapore iron ore prices rose by 0.3% to $105.90 per ton.