In short, an inversion indicates a lack of confidence in economic growth.

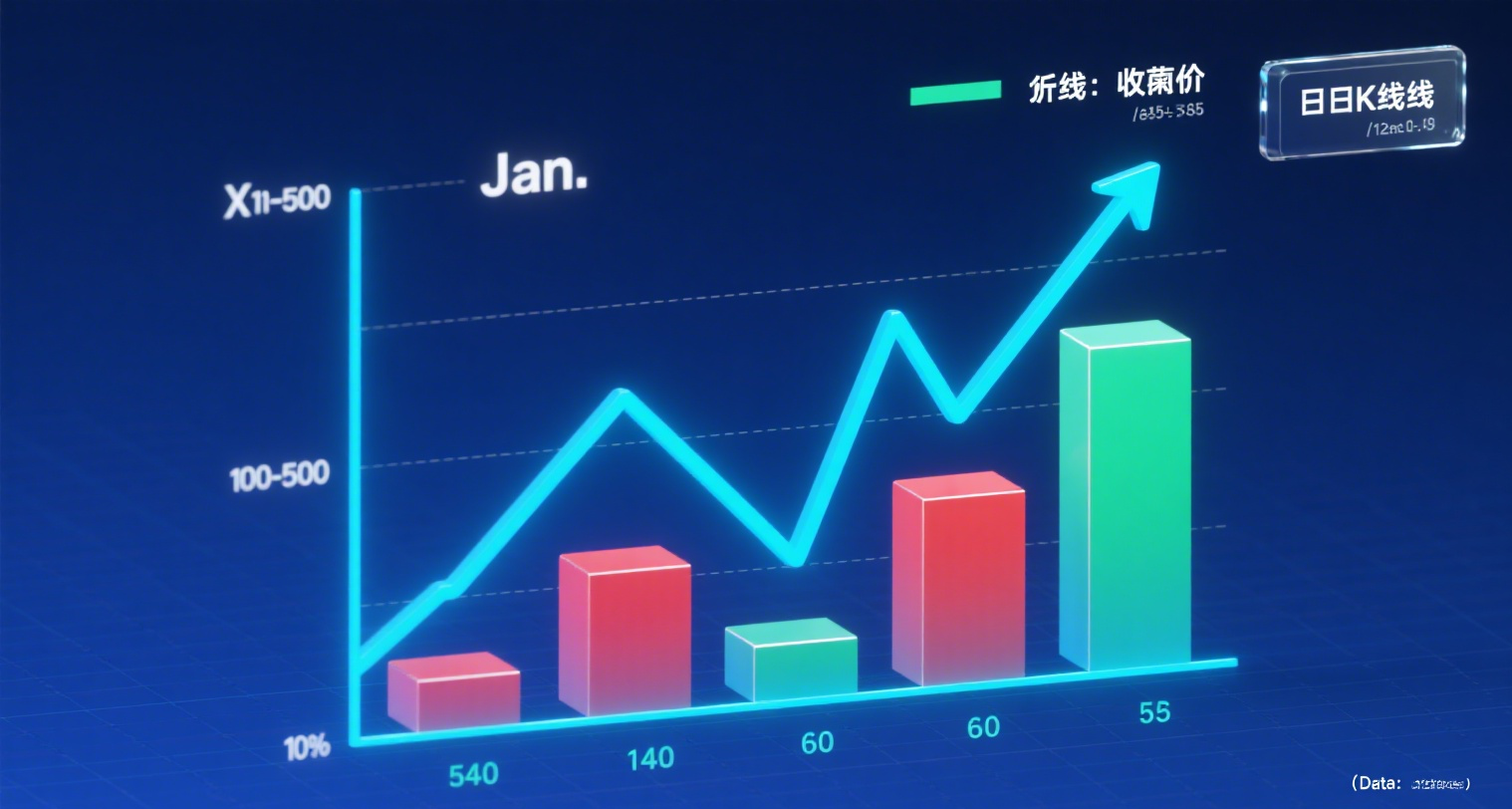

This year’s yield curve has another peculiarity—repeated inversions. Since the beginning of this century, there have been few periods of inversion calculated based on the spread between 10-year and 3-month Treasury yields. However, within about half a year this year, the yield curve has inverted 12 times.

Repeated "inversions" mean the market is repeatedly skeptical. In the dollar market, investors believe there is significant uncertainty about the future economy.

Directly impacted are trend-following hedge funds in the market. These funds are most effective when asset prices move in a sustained unidirectional trend—either consistently rising or consistently falling. However, this year, market expectations have frequently shifted, with no clear trend, inevitably causing severe losses for these funds.

Relevant data shows that in the first half of this year, the flagship fund of the world’s largest listed hedge fund, Man Group, fell by 7.8%, while the entire trend-following fund sector averaged a decline of 9.6%, expected to be the worst annual performance since 1998.

However, numerically, these tariff revenues are far from sufficient to alleviate fiscal pressure. Even if the recent tariff revenue of approximately $29.6 billion per month is accumulated over ten years, it would only amount to about $3.55 trillion, roughly equivalent to the projected increase in the deficit under the U.S. "Build Back Better Act" over a decade. Yet, compared to the cumulative federal deficit of approximately $22.7 trillion over the next ten years, it remains far from adequate.

An expanding fiscal deficit means that the risk of holding long-term U.S. bonds is gradually increasing—because the market expects the U.S. may need to borrow more money to cover the deficit in the future, thus demanding higher interest as compensation.

From a medium- to long-term perspective, this directly leads to rising U.S. Treasury yields, increased government borrowing costs, and also raises financing costs for businesses and individuals, putting pressure on economic growth. In the long run, the accumulation of such risks will weaken the attractiveness of the U.S. dollar.