Lithium Carbonate's 4-Day Surge: Bulls vs. Bears Battle in Yichun as Investors Stalk Mines at

Midnight

"Fully recognize the harm of 'involution-style' competition and respond to the central government's deployment to comprehensively address it." On August 7, Duan Debing, a standing committee member of the China Nonferrous Metals Industry Association, made this statement at a lithium industry conference in Yichun, Jiangxi, marking the beginning of this lithium mining storm.

News of CATL's lithium mine suspension continued to spread over the weekend. On August 9, Futures Daily confirmed through cross-verification that mining operations at CATL's Jianxiawo mine had indeed halted. Bloomberg also cited sources stating that CATL's lithium mining would be suspended for at least three months.

Before Monday's market opening, the news was confirmed when CATL responded to investor inquiries, acknowledging that mining operations had stopped after its Yichun project's mining permit expired on August 9. Market sentiment ignited instantly: lithium carbonate futures hit limit-up at the open, and multiple lithium mining stocks, including industry giants Tianqi Lithium and Ganfeng Lithium, surged to their daily upper limits.

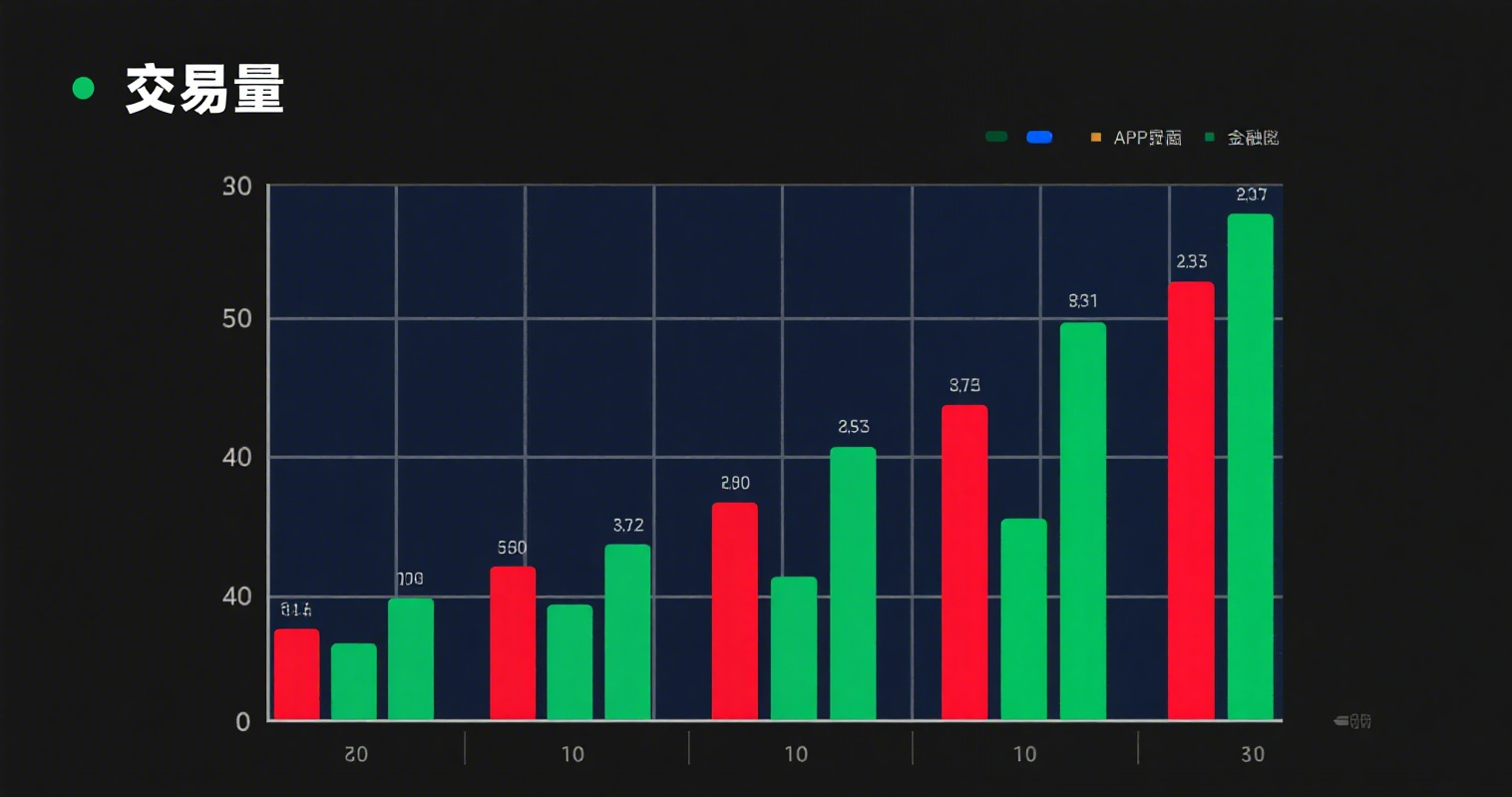

By August 12's close, the lithium carbonate futures contract settled at 82,520 yuan per ton, up 2%. Over four trading days from August 7 to August 12, the contract's price surged by 18.5% cumulatively.

Investors Stalk Mines Amid Bull-Bear Battle

The turmoil began with a July 7 notice from Yichun’s Natural Resources Bureau, ordering eight lithium-involved mining firms to submit revised mineral reserve reports by September 30. The issue stemmed from improper approvals that classified lithium-bearing ores as "ceramic clay," requiring reclassification through scientific review.

A report from COFCO Futures Research revealed these eight mines had an annual licensed capacity of 73.9 million tons (raw ore), with seven active mines producing 43.9 million tons annually—about 20% of China’s monthly output.

The market interpreted this as a major supply-tightening signal amid anti-"involution" efforts. "Yichun’s mines have long had regulatory gaps," a lithium industry insider told Yicai.

Following the news, lithium carbonate futures surged from 63,400 yuan/ton on July 7 to 79,500 yuan/ton by July 25 before bull-bear disputes triggered a pullback to 67,800 yuan/ton.