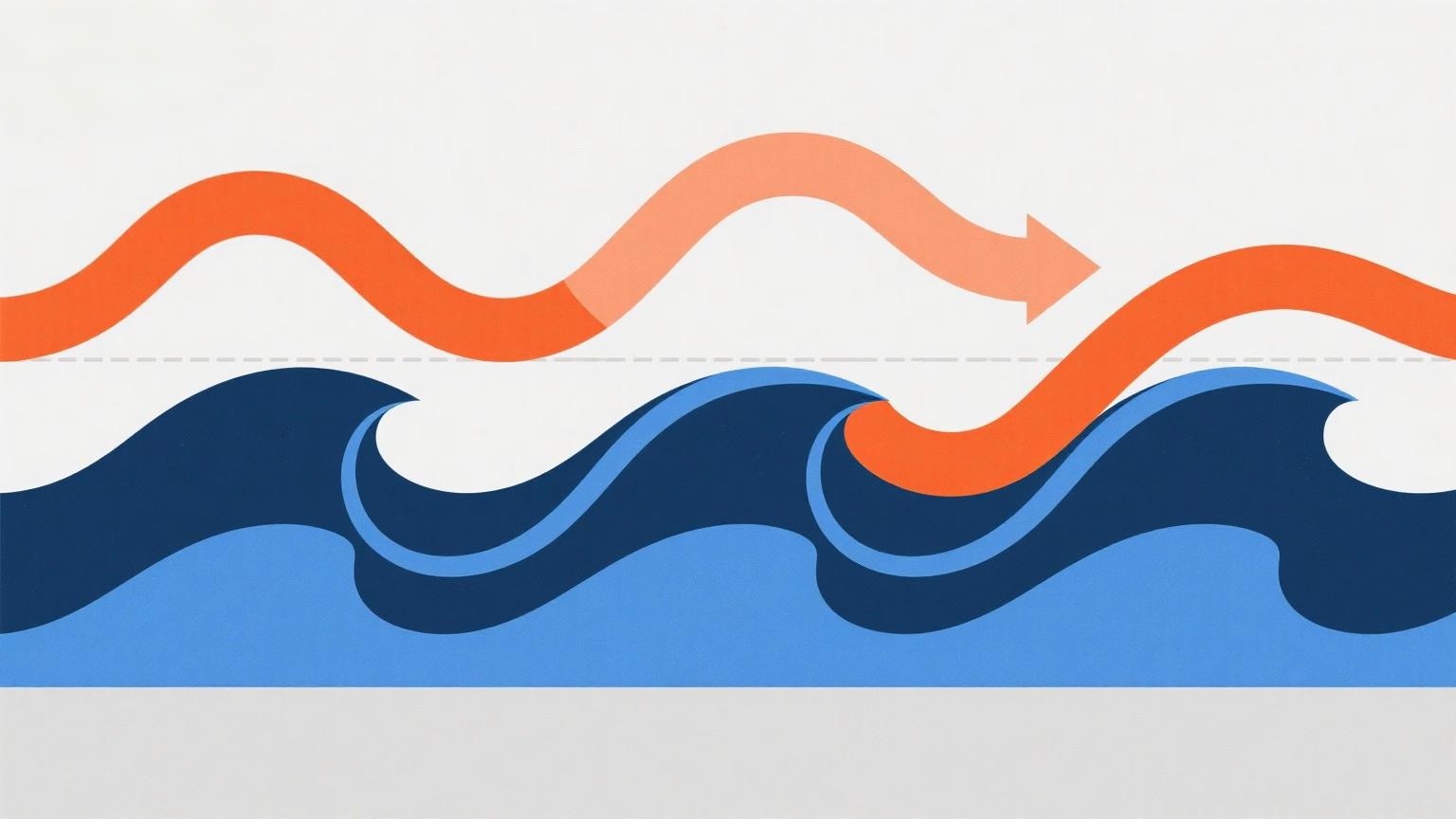

The full name of Wave Theory is Elliott Wave Theory, a concept developed by American securities analyst Ralph Nelson Elliott using the Dow Jones Industrial Average as a research tool. He believed that market trends repeatedly follow a pattern, with each cycle consisting of 5 upward waves and 3 downward waves. It is a widely used technical theory in the market.

In Wave Theory, the eight waves are referred to as Wave 1, Wave 2, Wave 3, Wave 4, Wave 5, Wave A, Wave B, and Wave C. Waves 1 to 5 collectively form an upward trend, with Waves 1, 3, and 5 being impulse waves, and Waves 2 and 4 being corrective waves. Waves A to C collectively form a downward trend, with Waves A and C being impulse waves, and Wave B being a retracement wave.

Wave Theory has several fundamental principles, some of which are excerpted below:

-

A complete cycle consists of eight waves—five up and three down.

-

Among Waves 1, 3, and 5, Wave 3 cannot be the shortest.

-

Wave 2 retraces deeply but will not erase 100% of Wave 1's gains.

-

The bottom of Wave 4 must not fall below the peak of Wave 1.

-

Common retracement ratios include 0.382, 0.5, and 0.618.

-

It primarily reflects crowd psychology and is applicable to indices or widely traded instruments.

However, the key rules of Wave Theory cannot entirely determine which wave of which cycle the current market is in. This leads to varying interpretations ("a thousand people, a thousand waves"), and the theory's relative complexity greatly limits its widespread adoption in the market.