Where to Start with Stock Trading? Key Points to Note

1. How to Begin Learning Stock Trading?

-

Basic Knowledge: Understand stock types, market mechanisms, and trading rules.

-

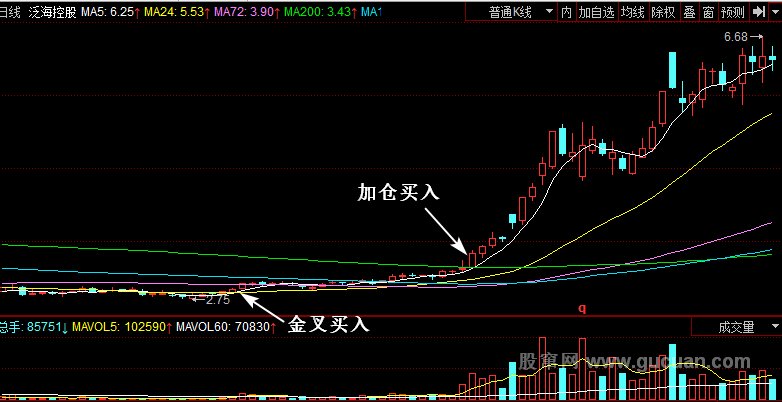

Technical Analysis: Learn to use charts (K-line, MACD, RSI, moving averages) to analyze trends and make decisions.

-

Fundamental Analysis: Study company financials, growth prospects, and industry position.

-

Practical Experience: Practice risk management, position sizing, and trading strategies.

-

Also, monitor industry trends, economic policies, and global events, as they impact markets.

2. How to Improve After Mastering the Basics?

-

-

Macroeconomic Analysis: Track economic cycles and industry trends to predict market movements.

-

Trading Psychology: Control emotions (greed/fear) to avoid impulsive decisions.

-

Advanced Technical Analysis: Master complex indicators and trend strategies.

-

In-Depth Financial Analysis: Analyze balance sheets, cash flow statements, and income statements to assess risks.

-

Corporate Governance: Study management structures and board dynamics to identify opportunities.

3. Influential Stock Market Theories

-

Dow Theory (Charles Dow): Markets move in trends, predictable via technical analysis.

-

Gann Theory (W.D. Gann): Markets follow cyclical patterns (e.g., 57-day rule, "rising sun, falling moon").

-

Mean Reversion: Prices eventually return to averages, creating arbitrage chances.

-

Elliott Wave Theory: Trends consist of repetitive wave patterns for forecasting.

-

Modern Portfolio Theory (Markowitz): Diversification balances risk and return.

-

Value Investing (Benjamin Graham): Buy undervalued stocks for long-term gains.

-

Growth Investing: Focus on high-growth companies for capital appreciation.

-

Mastering these theories enhances investment skills.

-