On November 11 local time, U.S. stocks were mixed. At the time of writing, the Dow Jones Industrial Average was up 0.36%, the Nasdaq Composite was down 0.74%, and the S&P 500 was down 0.29%.

Most large-cap tech stocks fell. At the time of writing, Apple was up 1.59%, Amazon was down 0.16%, Microsoft was down 0.46%, Google was down 0.52%, Facebook was down 1.64%, Tesla was down 2.28%, and Nvidia was down 3.31%.

In terms of news, the renowned tech investment firm SoftBank disclosed in its latest earnings report that it had "liquidated its Nvidia position," raising $5.83 billion. SoftBank also reduced its stake in T-Mobile, raising $9.17 billion. The last time SoftBank liquidated its Nvidia position was in 2019, netting a $3 billion profit on a $4 billion investment. However, had it not sold those shares, the unrealized gain would have exceeded $240 billion today.

Separately, according to sources, Meta's Chief AI Scientist Yann LeCun plans to leave and start his own company. It is reported that LeCun is currently in early-stage talks with potential investors to raise funds for his startup.

Spot gold plunged. At the time of writing, it was at $4108 per ounce, down 0.18%.

US Labor Market "Raises Red Flags"

The US Dollar Index had previously plunged. At the time of writing, it was at 99.3667, down 0.25%.

Regarding the news, the US labor market is showing signs of deterioration.

According to data from payroll services firm ADP, the US private sector lost an average of 11,250 jobs per week in the four weeks leading up to October 25.

The agency stated that the relevant data indicates "the labor market struggled to sustain job growth in the second half of the month."

Starting last month, in addition to its long-standing monthly report, ADP introduced a higher-frequency labor market reading. This new reading is based on a four-week rolling average and has a two-week publication lag.

This report does not cover government employees. As the government shutdown has delayed the release of other indicators, it provides a reference for the labor market, leading economists and investors to pay increasing attention to these alternative data sources.

In recent weeks, several companies have disclosed plans to reduce their workforce. A report from outplacement firm Challenger, Gray & Christmas showed that announced job cuts in October were the highest for that period in over two decades, heightening concerns about the labor market's health.

Another dataset from the University of Michigan showed that 71% of respondents expect the unemployment rate to rise in the coming year, the highest proportion since 1980.

The longest government shutdown in US history has led to delays in the release of key economic statistics, including the September and October employment reports. Investors are turning to other indicators like ADP to fill the information gap.

Economists at Goldman Sachs estimate that US non-farm payrolls may have decreased by 50,000 in October, after accounting for employees participating in the government's "furlough and resignation plans." They believe the risk of labor market deterioration has increased.

Analysis points out that the latest employment data has increased expectations for interest rate cuts. Data shows the probability of a Fed rate cut in December is close to 70%.

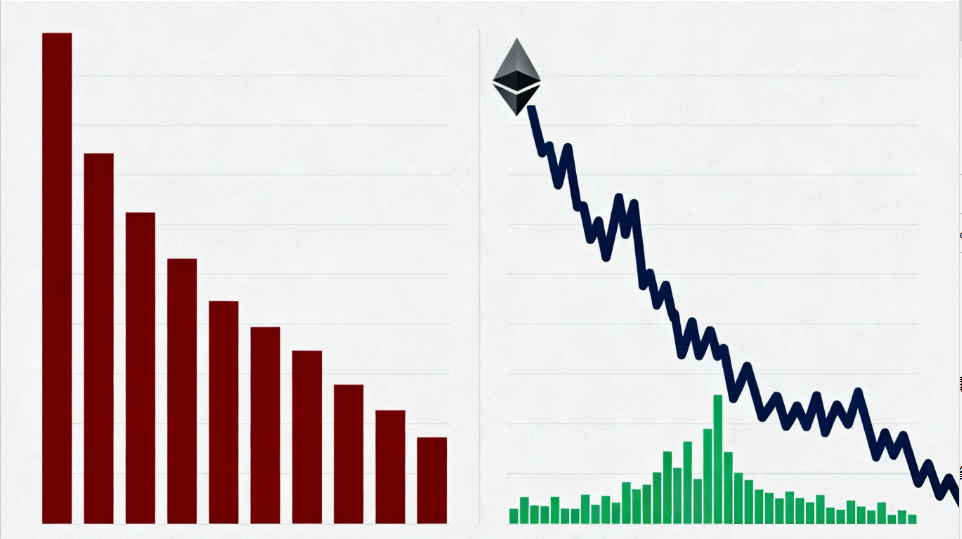

Cryptocurrencies Plunge Collectively

Over 140,000 Accounts Liquidated

Cryptocurrencies plunged collectively. At the time of writing, Bitcoin had fallen to $103,881, and Ethereum had broken below $3,500, falling nearly 2% in the past 24 hours. Across the entire market, over 140,000 accounts were liquidated, with total liquidation amounts reaching $417 million.

Regarding the news, the International Organization of Securities Commissions (IOSCO) stated in a report on Tuesday that crypto tokens linked to mainstream financial assets could pose new risks for investors. Currently, the financial industry remains divided on the pros and cons of "tokenization."

So-called "tokenization" refers to creating corresponding tokens on a blockchain for real-world assets like stocks or bonds. This concept has regained attention from cryptocurrency enthusiasts this year, and some new tokenized products have been sold to the public through online brokers.

IOSCO's members include regulators from nearly all securities markets globally. IOSCO stated that most risks associated with tokenization still fall within the scope of existing regulatory frameworks, but the underlying technology could introduce new risks and vulnerabilities.

Tuang Lee Lim, Chair of the IOSCO Board-level FinTech Task Force, said: "Although current adoption remains limited, tokenization has the potential to reshape how financial assets are issued, traded, and serviced."

IOSCO added that different ways of structuring tokenized assets might make it difficult for investors to determine whether they hold the underlying asset or merely the corresponding crypto token; simultaneously, token issuance by third-party institutions introduces counterparty risk. This view echoes some concerns raised by EU securities regulators in September.

IOSCO also stated: "Tokenization markets may suffer from spillover effects due to increased correlation with crypto-asset markets."

Currently, some mainstream financial institutions, including Nasdaq, are promoting tokenization businesses, but other Wall Street participants remain cautious.

For years, many financial institutions have attempted to issue blockchain-based versions of assets.

IOSCO stated that commercial interest in tokenization is rising, but practical application remains "limited."

Proponents of tokenized assets argue that blockchain technology can reduce transaction costs, speed up settlement, enable 24/7 trading, and attract younger investors.

However, IOSCO pointed out that these so-called "efficiency gains are uneven," as market participants still rely on traditional market infrastructure during the trading process, rather than being entirely replaced by blockchain.

"Issuers generally do not publicly disclose any actual quantifiable data on efficiency gains, if any," IOSCO added.

(Disclaimer: The article content and data are for reference only and do not constitute investment advice. Investors proceed accordingly at their own risk.)